2019 Adhesives and Sealants Raw Materials and Chemicals Overview

Use trends, price fluctuations, and availability of raw materials all have important implications for the adhesives and sealants industry.

Figure 1. U.S. crude oil production, 1940-2019 (million barrels per day).

(Source: U.S. Energy Information Administration.)

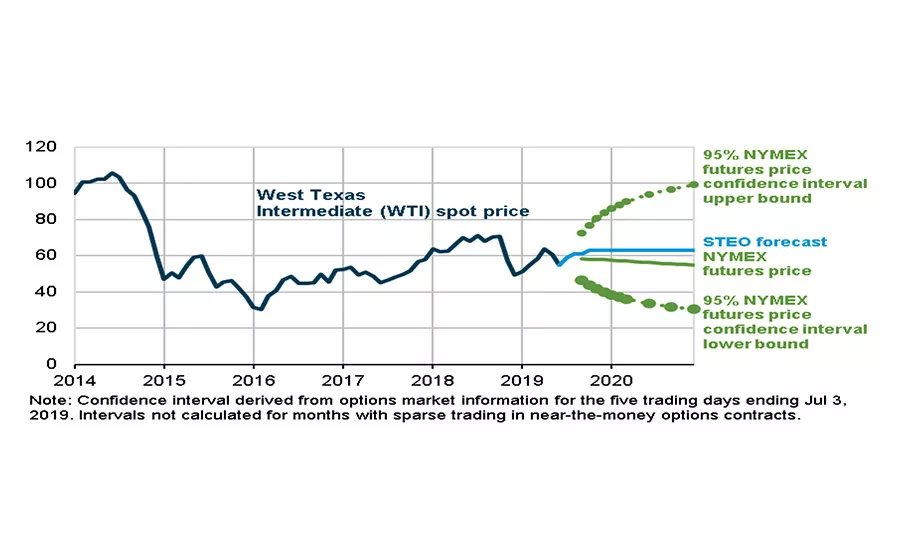

Figure 2. West Texas Intermediate (WTI) crude oil price and NYMEX confidence intervals ($ per barrel).

(Sources: “Short-Term Energy Outlook,” July 2019, U.S. Energy Information Administration; and CME Group.)

Raw materials used in the manufacturing of adhesives and sealants represent a small yet important part of the global chemical industry. Raw materials constitute a majority of the cost of goods sold (COGS) for adhesives and sealants. The chemical building blocks used to produce adhesives and sealants can also be used to produce a wide array of other chemical compounds.

Use trends, price fluctuations, and availability of raw materials all have important implications for adhesives and sealants formulators and the industry as a whole. Not unexpectedly, key markets are competing for certain raw materials and their precursors, particularly during periods of tight supply. Indeed, volatility in raw material pricing or supply availability have resulted in technology resources being shifted from innovation projects to validating alternate vendors or substitute materials during periods of short supply.

Oil and Gas

Adhesives and sealants producers are sensitive to crude oil prices due to the preponderance of oil-derived feedstocks. In 2019, global oil demand reached a record 101 MMbbl/day, and natural gas continued to expand in usage. Global crude oil demand is forecast to remain stable and grow at 1% per year.

The boom in U.S. oil and natural gas production driven by favorable shale gas economics is forecast to make the U.S. a net energy exporter in 2020, something the U.S. has not achieved in nearly 70 years, according to the U.S. Department of Energy. The U.S. will start exporting more energy products than it imports as U.S. crude output continues to grow and domestic oil consumption declines. Figure 1 (p. 13) shows the growth trend in U.S. crude oil production. Increasing shipments of natural gas and petroleum byproducts will further boost the country’s role as a major energy exporter.

After years of volatile natural gas prices, new domestic supplies of more affordable natural gas and natural gas liquids (NGLs) have created a competitive advantage for U.S. chemical manufacturing. Companies from around the world are investing in new projects to build or expand their shale-advantaged capacity in the U.S. Since 2010, 334 projects valued at $204 billion in total have been announced.

The development of U.S. shale gas has also increased the supply of natural gas and NGLs, including ethane, propane, and butane. These serve as important feedstocks for petrochemical production and as adhesives and sealants raw material precursors, including ethylene, propylene, and vinyl acetate monomer (VAM). Importantly, U.S. gas crackers have a commercial advantage over the naphtha-based crackers located in Europe and Asia; they can even compete with the light-feed crackers in the Middle East.

Ethylene

Ethylene is used as a feedstock in the manufacture of plastics, fibers, and other chemicals that are used in the packaging, transportation, and construction industries, as well as an array of other markets. Ethylene consumption has increased at an average rate of 4% per year, with the majority of the increase coming from Asia, North America, and the Middle East.

Driven by the shale oil “ethane advantage,” U.S. ethylene producers remain favorably advantaged vs. naphtha-based ethylene producers in Europe and Asia. While the price of ethylene is typically tied to the price of naphtha, the availability of ethane from shale resources has allowed U.S.-based ethylene producers to shift to advantaged raw materials.

Ethylene supply is expected to keep up with demand, and low prices for NGLs (including ethane) are forecast to remain through the early 2020s. Polyethylene is, by far, the largest ethylene use. The derivatives that are most important to the adhesives and sealants industries reside in the benzene chain to produce styrene and the methanol chain to produce vinyl acetate monomer (VAM).

The U.S., the Middle East, and Western Europe will grow to be net exporters of ethylene. Asia, Latin America, Central and Eastern Europe (CEE), and India are expected to all be net importers.

Propylene

By volume, propylene is the second-most produced chemical globally. Demand is mostly for the production of polypropylene, followed by propylene oxide, acrylonitrile, cumene, and acrylic acid. Propylene demand is expected to grow at 4% per year, primarily in Asia. The most growth will occur in China, the U.S., the Middle East, and the Commonwealth of Independent States (CIS) and Baltic States.

New propylene capacity will be developed where most of the demand growth is taking place: Asia and North America. As ethane cracking further increases globally, resulting in a shift toward lighter feedstocks, the need will grow for on-purpose propylene production. The extent of on-purpose production is expected to account for nearly 30% of the global propylene production by 2021 and may account for as much as half of production in North America.

Vinyl Acetate Monomer

VAM is almost all used as a vinyl monomer to produce polyvinyl acetate homopolymers and copolymers, which are often further reacted to produce derivatives such as polyvinyl alcohol (PVA) and ethylene-vinyl alcohol (EVOH). The areas of most growth are ethylene-vinyl acetate (EVA) and vinyl acetate-ethylene (VAE) copolymers. Other applications for vinyl acetate include polyvinyl butyral (PVB), used in laminated safety glass and EVOH.

Volume in the main end-use markets for vinyl acetate (e.g., paints, adhesives, textiles, and safety glass sheet for automotive and architectural applications) is cyclical and depends on the performance of building and construction and automotive markets. Overall growth in vinyl acetate consumption will be driven by demand in China and the U.S., at an average annual rate of about 2.5%. In North America and Western Europe, polyvinyl acetate accounts for over half of consumption.

Butadiene

The single largest use for butadiene is in the production of synthetic elastomers, including styrene-butadiene rubber (SBR) and polybutadiene rubber, both of which are used in tire manufacture. Produced from a copolymer of styrene and butadiene, SBR is the most widely used synthetic rubber in adhesives and sealants.

Global butadiene demand is expected to grow at an average annual rate of about 2%. Acrylonitrile butadiene styrene (ABS) resin manufacturing is the fastest-growing application for butadiene and the second-largest use. Elastomer manufacturing is forecast to grow at a slower rate of 2% per year.

Butadiene demand in tires can fluctuate with new vehicle production, design changes, replacement tire demand, and the price of substitute materials. These factors all contribute to the cyclical nature of butadiene demand.

Butadiene is also impacted by changes in feedstocks; as feedstocks shift to ethylene, much less butadiene is produced vs. when other feedstocks are used. The shift in the U.S. to lighter feedstocks has reduced the amount of byproduct butadiene production from crackers.

Regional demand is highest in Asia, comprising 50% of the total volume, followed by North America and Western Europe. Western Europe is a major exporter, along with North America and Asia ex-China. China production is relatively balanced, as it is becoming increasingly self-sufficient.

Styrene

Just over half of styrene production goes into polystyrene and expandable polystyrene (EPS), which are used in building materials/construction and packaging markets. As previously mentioned, SBR is used mostly in synthetic rubber in adhesives and sealants and is produced from a copolymer of styrene and butadiene. The next-largest uses are in producing ABS/SAN resins. Global styrene consumption is forecast to stay relatively flat, growing at an average rate of 2% per year.

Styrene is produced through the reaction of ethylene and benzene. While benzene is not regionally advantaged, the U.S. maintains a styrene cost advantage due its advantaged ethylene position based on shale gas economics.

Northeast Asia remains the dominant region in the styrene industry, led by China. Styrene capacity is expanding in China as the country becomes increasingly self-sufficient.

Acrylic Acid

Crude acrylic acid (CAA) is made by the oxidation of propylene. More than half of CAA produced is converted into acrylate esters. The remaining 45% is purified to glacial acrylic acid (GAA), which, in turn, is converted to polyacrylic acid, the majority of which is consumed with superabsorbent polymers. Markets for the esters include surface coatings, textiles, adhesives, and plastics. Polyacrylic acid or copolymers have applications in superabsorbents, detergents, dispersants, flocculants, and thickeners. Superabsorbent polymers (SAPs) are used primarily in disposable diapers and incontinence products. Adhesives comprise around 14% of the total volume consumption.

GAA consumption is forecast to grow at about 5% per year. Demand is highest in China, with approximately one-third of the total volume, followed by the U.S. and Western Europe. Growth in demand for crude acrylic acid is forecast at 4.5% per year, driven by growth in SAP at 5.5% and acrylate esters at about 4%. SAP growth will be strongest in China and other areas of Asia, as consumers in those regions increasingly use disposable diapers and incontinence products.

For more information, visit https://chemquest.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!