2020 Raw Materials and Chemicals Overview

What repercussions has COVID-19 had on price fluctuations and availability for key raw materials used in the adhesives and sealants industry?

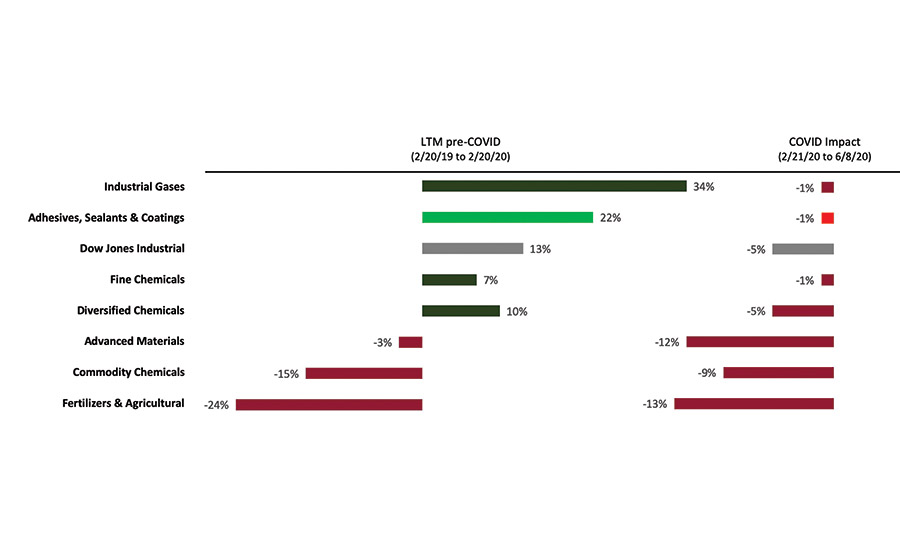

As a vital industrial link between a turbulent oil and gas market and changing consumer needs, the chemical industry has been tested by the COVID-19 pandemic. According to William Blair, global demand for chemicals is experiencing severe shocks across end markets, global supply chains are disrupted, stock prices of chemical companies have taken unprecedented hits, and the competitive order of chemicals producers in the U.S., Middle East, China, and Europe has changed virtually overnight.

Companies serving highly cyclical end markets are experiencing significant decreases in demand due to global economic uncertainty and volatility in capital markets. These challenged end markets include automotive, residential and commercial real estate, discretionary consumer goods, building products and construction, and aerospace.

Conversely, some sectors of the chemicals industry are showing signs of resilience. Demand is expected to remain strong for chemicals used in end markets such as agriculture, pharmaceutical ingredients (APIs), life sciences, reagents, medical devices and supplies, food and beverage, and intermediates for consumer products (e.g., cleaning solutions, sanitizers, and detergents), according to William Blair.

Looking downstream to the adhesives and sealants market, the COVID-19 crisis has acted as a significant restraint as supply chains were disrupted due to trade restrictions and consumption declined due to lockdowns imposed by governments globally. However, it is expected that the adhesives market will recover.

Beyond transportation-related delays arising from travel restrictions and some driver shortage issues, COVID-19 has not hugely impacted supplies of raw materials for adhesives and sealants yet. The situation is highly fluid, but the availability of raw materials such as binders and resins has not yet become an issue.

However, that is not the case with all materials. There are shortages in three areas so far: alcohols, which understandably have been diverted toward hand sanitizers and other cleaning products; photoinitiators that are used in UV applications and primarily supplied from Europe and China; and dyes and pigments, which typically are supplied out of India, China, and Europe.

The geographic location of the supplier is a key consideration, with China and India being the most challenging. An additional issue related to China is that the country is taking a predatory approach. Many are seeing 12-15% export tax rebates (the highest for some time) for exported products like pigments and resins as China attempts to regain lost share due to both tariff restrictions and COVID-19.

Oil Price Collapse

Adhesives and sealants producers are sensitive to crude oil prices due to the preponderance of oil-derived feedstocks. Because of COVID-19, the oil and gas industry is experiencing its third price collapse in 12 years.

The oil price reaction to COVID-19 was gradually accommodated until March 9, 2020, when—49 days after the release of the first coronavirus monitoring report by the World Health Organization (WHO)—Saudi Arabia announced it would raise production and offer its crude at deep discounts. This announcement, coupled with the global impact from the coronavirus, resulted in oil prices falling 50% since the beginning of the year and great uncertainty continuing for future price movements.

All crude oil benchmarks have seen sharp falls, with some (particularly those facing transport bottlenecks and lower inventory capacity) seeing prices fall to negative levels. While oil price declines provided short-term margin relief for many companies, falling oil prices will lead to steep price cuts for chemicals going forward as manufacturers continue to face weaker demand for their products in a down economy.

Looking forward, Moody’s expects WTI crude prices to average $30 a barrel in 2020 and $40/bbl in 2021, while Brent crude oil is expected to average $35/bbl this year and $45/bbl in 2021. Moody’s oil price projections are bearish compared to S&P Global Platts Analytics’ outlook issued in July, which calls for an average WTI price of $37.50/bbl in 2020 and $40.70/bbl in 2021. Evercore ISI analysts said on August 20 that they see Brent prices rising to $50/bbl by the end of 2020 and ticking up to $55/bbl by the end of 2021, posting a yearly average of $45/bbl in 2020 and $50/bbl in 2021.

Ethylene

Ethylene is the petrochemical industry’s key building block. It is the substance from which approximately 60% of other organic chemicals are derived.

Historically, global demand for ethylene has grown at a multiple of global GDP growth. However, according to IHS, the relationship between ethylene demand growth and economic growth is becoming less straightforward these days, as ethylene demand to GDP elasticity is being diluted by the increasing influence of the technology and services sector on GDP growth and the correspondingly lower impact of manufacturing.

In addition, due to a strong push toward sustainability and recycling, some ethylene demand has been replaced by recycled or natural materials (e.g., paper and glass). This is resulting in lower multiples to GDP growth, especially in developed countries.

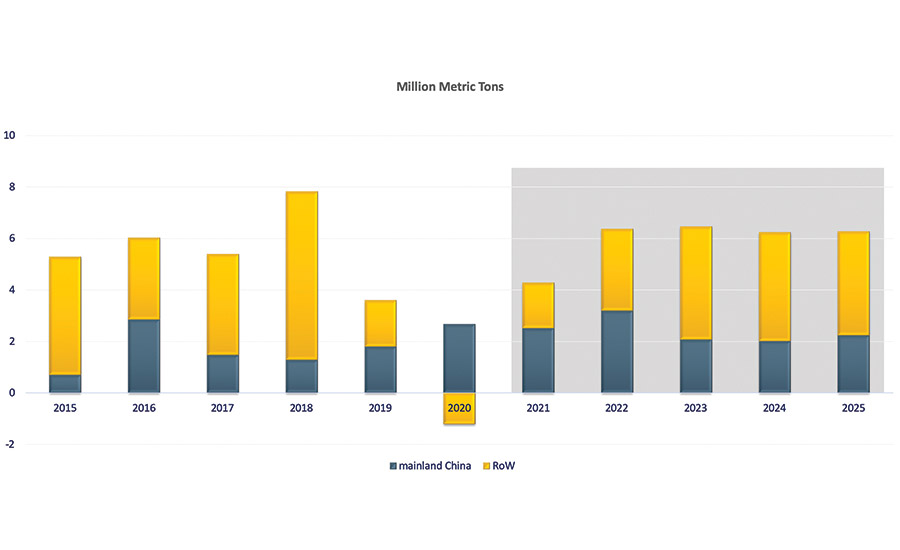

The COVID-19 pandemic has caused demand growth to be negative across various regions, but this is more than offset by growth observed in mainland China (see Figure 2). Globally, IHS estimates that demand will grow by approximately 1.5 million metric tons (Mt) in 2020; it is forecast to grow by approximately 4 Mt in 2021 and more than 6 Mt year-on-year in 2022-2025.

The global capacity addition has been uneven across global regions, influenced by infrastructure and port facilities, feedstock competitiveness, economic growth, and demand. Asia and the Middle East have been leading new ethylene capacity addition in the past decade. Asia—particularly mainland China—will continue to do so in the next decade.

Global operating rates are expected to fall from approximately 89% in 2019 to 85% in 2020 and to subsequently hover at the low end of the 80-89% range until 2025, as global capacity addition is expected to outpace demand growth in the short term. According to IHS, operating rates are forecast to rise to the high end of the 80-89% range toward 2028-2030.

Propylene

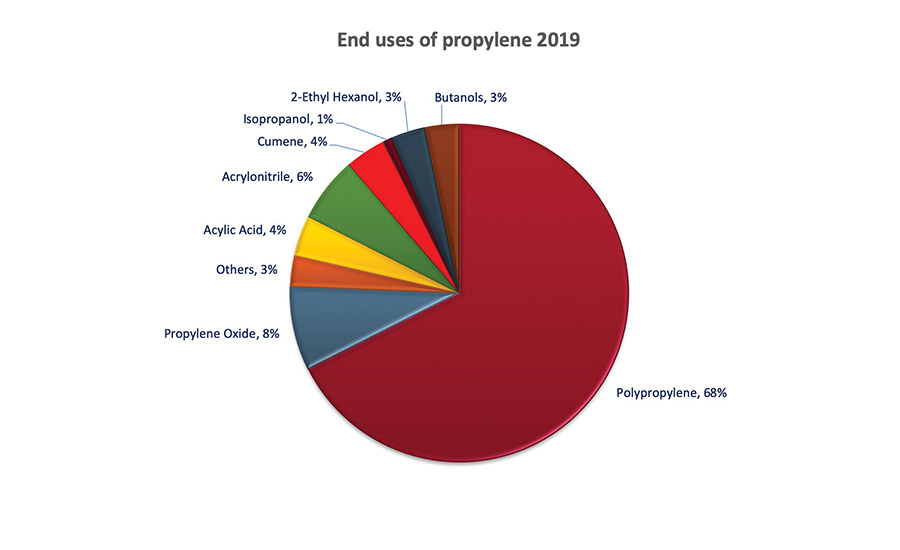

The second-largest volume chemical produced globally, propylene has many end uses (see Figure 3). Propylene consumption has been increasingly linked to emerging countries (particularly China), where the improvement in living standards and growing urbanization are driving increasing use of a broad spectrum of polymers and chemicals.

Global propylene trade is dominated by Northeast Asia. In 2019, the region accounted for about 52% of global exports and 61% of global imports. IHS estimates that China covers about 87% of regional propylene imports.

Trade throughout 2019 was steady and remained stable. 2020 started with the propylene market in severe oversupply, and lackluster demand prompted inventories to reach record highs. However, trade in 2020 has dropped significantly. Looking at China’s imports of propylene, which are reliant on South Korea and Japan, the levels dropped by almost 50% in January through to March before a slow recovery happened throughout the second quarter.

The COVID-19 pandemic hit gasoline demand particularly hard. As lockdowns reduced vehicle miles driven, refiners responded by throttling back refinery runs and fluid catalytic cracker operating rates. As a result, total propylene production fell by 1.2 billion pounds in the first half of 2020 vs. the same period a year earlier.

Vinyl Acetate Monomer

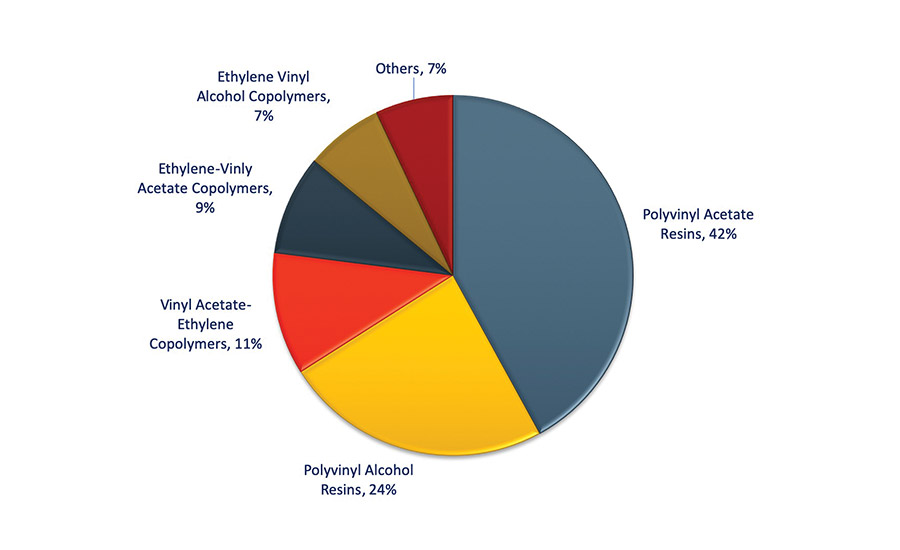

Vinyl acetate monomer (VAM) is a significant intermediate used in the production of a wide range of resins and polymers for paints and coatings, adhesives, glues and sealants, elastomers, textile finishes, paper coatings, binders, films, and myriad other industrial and consumer applications (see Figure 4). The largest end use for VAM is in the production of polyvinyl acetate (PVA) resins as a base for adhesives and coatings, as well as a feedstock for derivative resins like polyvinyl alcohol (PVOH).

Polyvinyl acetate emulsions and resins are low in cost and convenient to use, and they have a wide application range. PVA is likely best known as the base component of household white glues used for bonding paper, fabrics, wood, and plastic.

Worldwide consumption of VAM measures over 4 Mt, with an annual growth rate of about 4.7%. However, according to Gantrade, acetic acid demand is expected to decline by approximately 8% year-over-year, and VAM demand is expected to decline about 9% in 2020 due to weaker demand from COVID-19; both are expected to see demand rebound in 2021.

In response to lower demand, producers are expected to decrease operating rates. For example, the average operating rates in China for acetic acid were 58% in the first week of May vs. 66% in April.

Butadiene

Butadiene is a large-volume chemical produced globally (see Figure 5). It is an important raw material for the production of organic chemicals such as polybutadiene elastomers, styrene-butadiene rubber (used in the manufacture of tires), acrylonitrile butadiene- styrene (ABS) resins, styrene-butadiene latexes, and adiponitrile, as well as for a variety of other industrial products.

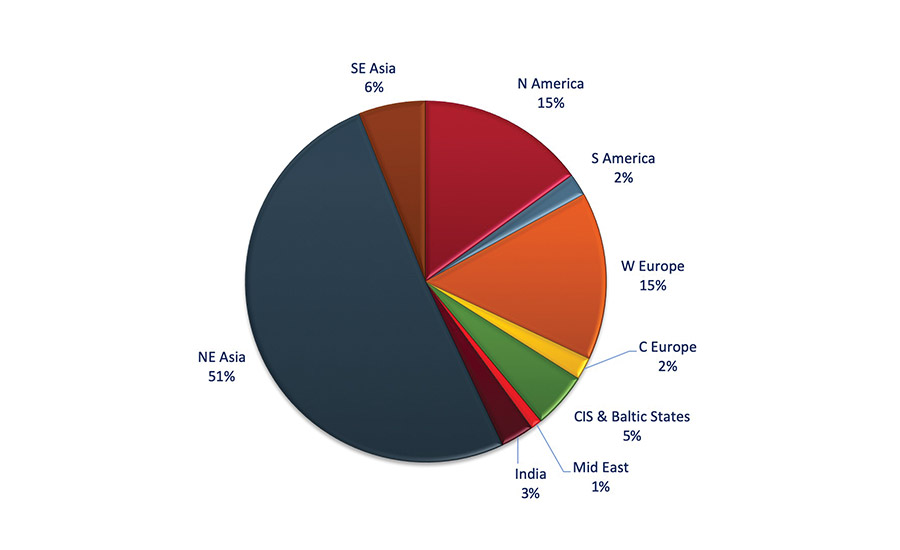

In 2019, global production of butadiene reached about 12 Mt, with the major producing regions being Northeast Asia (47%), Western Europe (18%), and North America (12%). Unlike other olefin products, butadiene is not significantly produced in the Middle East.

West Europe is a relatively significant exporter, while North America and Asia ex-China are the major net importers. IHS believes that China will trend toward higher self-sufficiency for butadiene in the coming years, as will North America as new crude C4 production comes online.

Rubber and elastomers make up approximately 70% of global demand. Most of this is consumed in vehicle tires, belts, hoses, grommets, etc. IHS expects vehicle production to decrease in 2020, which will be a headwind for butadiene demand.

Butadiene prices have historically been volatile because of the interplay between natural rubber and oil-based synthetic rubber. From 2014 through the first half of 2016, prices were relatively calm; however, prices were volatile during the 2016 second half through the 2017 first half due to a spike in demand from China (related to automotive), lower inventories across the chain, and several one-off operating issues. Despite the recent volatility of crude prices, IHS is calling for butadiene prices to be relatively stable vs. the past.

Styrene

Global styrene margins are near record lows due to weakening demand stemming from the COVID-19 pandemic and increasing global supply. This follows an eight-year period of modest global capacity expansions. Coupled with some capacity shutdowns in Europe and Japan, net supply growth essentially kept pace with incremental demand growth during this period. These balanced supply/demand fundamentals supported a five-year (extended) styrene upcycle (2014-early 2019), during which styrene margins reached near record levels in 2018.

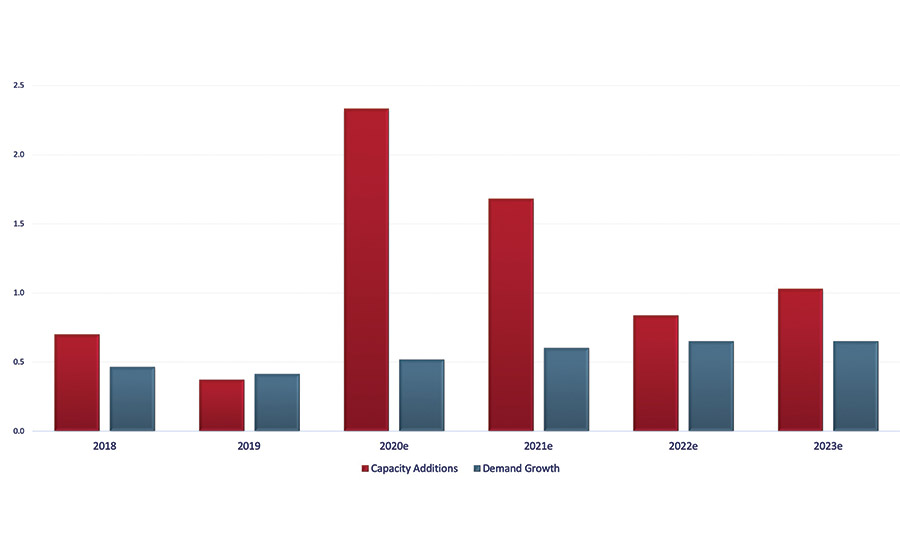

However, starting in 2020 and continuing for the next five years, global styrene capacity additions are expected to exceed annual growth in global styrene demand (see Figure 6). These capacity additions are most pronounced in 2020-2021, during which nearly 4 Mt of styrene capacity is expected to start up (equal to 13% of global supply). Almost all of this new capacity is in China (Northeast Asia accounts for more than half of global styrene demand).

The 4 Mt of new styrene capacity in 2020-2021 compares with normalized annual styrene demand growth of roughly 0.5 Mt or just below 2% per year (global styrene demand was 30 Mt in 2019). However, with the advent of the (likely global) recession, IHS expects styrene demand to fall 1% in 2020. This is expected to drive global styrene operating rates from 88% in 2019 to 82% in 2020 and 80% in 2021. This excess supply is expected to pressure styrene margins to near breakeven levels in 2020-2021.

Slightly over half of styrene demand goes into polystyrene and expandable polystyrene, which produce foams used in packaging and building/construction insulation. The next-largest tranche is to ABS/SAN resins, which largely serve plastics for the electronics markets.

On average, styrene demand grows approximately half the level of global GDP growth, with polystyrene demand noted as stable. Growth is led by electronics/appliances and building/construction, while the packaging outlook is flat (for polystyrene) due to sustainability trends impacting packaging decisions.

For additional information, call (513) 469-7555 or visit www.chemquest.com.

Find suppliers of raw materials and chemicals at www.adhesivesmag.com/materialshandbook.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!