2021 Raw Materials and Chemicals Overview

The outlook for industrial demand is expected to improve, notwithstanding inflated raw material costs.

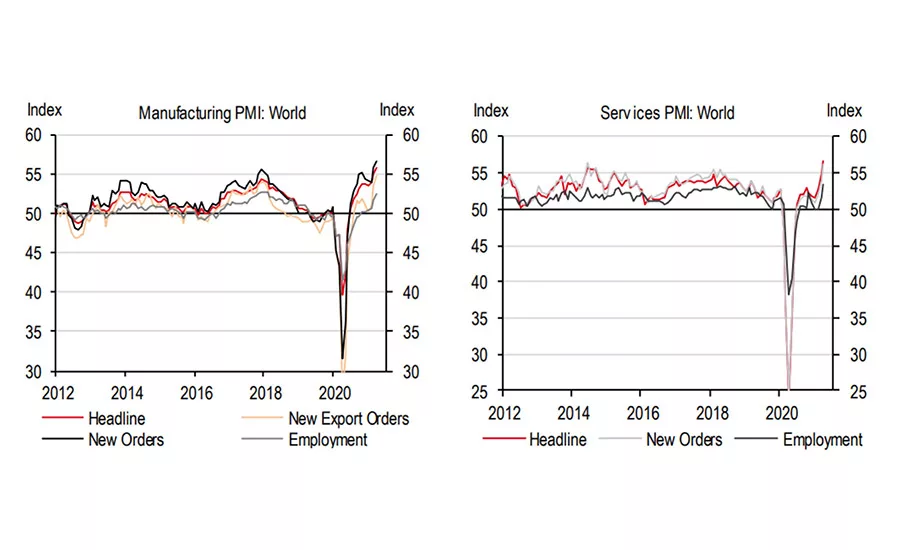

Figure 1. Purchasing Managers’ Index for manufacturing and services, 2012-2020. (Source: IMF)

Not surprisingly, the global economic recovery is continuing more quickly in regions where COVID-19 is under control and vaccinations have been widely rolled out. After an estimated contraction of 3.3% in 2020, the global economy is projected to grow at 6% in 2021, moderating to 4.4% in 2022, according to the International Monetary Fund (IMF).

Demand for manufactured goods remains strong, with the global aggregate Purchasing Managers’ Index (PMI) rising again to another decade high. Combined with persistent and widespread raw material and labor shortages, this is continuing to add to price pressures within the manufacturing sector. These appear to be being passed on, at least to a degree.

The U.S. economic outlook continues to strengthen, with economists boosting 2021 gross domestic product (GDP) growth forecasts encouraged by robust consumer spending and manufacturing activity. However, economists’ main concern is inflation.

Global Chemical Industry

The overall chemical industry should expect demand growth driven by the construction and mobility industries. The construction industry’s year-over-year output growth is estimated at 8% for 2021, with the U.S. and China expected to make massive investments in infrastructure.

While the global auto industry is suffering from chip shortages on the supply side, it will likely see demand rebound this year thanks to sales growth on increasing outdoor activities and pent-up demand in the second half of 2021. Chemicals demand for packaging materials and hygiene products should remain strong, albeit growing at a slower pace. Even after the COVID-19 crisis subsides, these industries will benefit from pandemic-sparked shifts in consumption patterns.

Crude Oil Prices

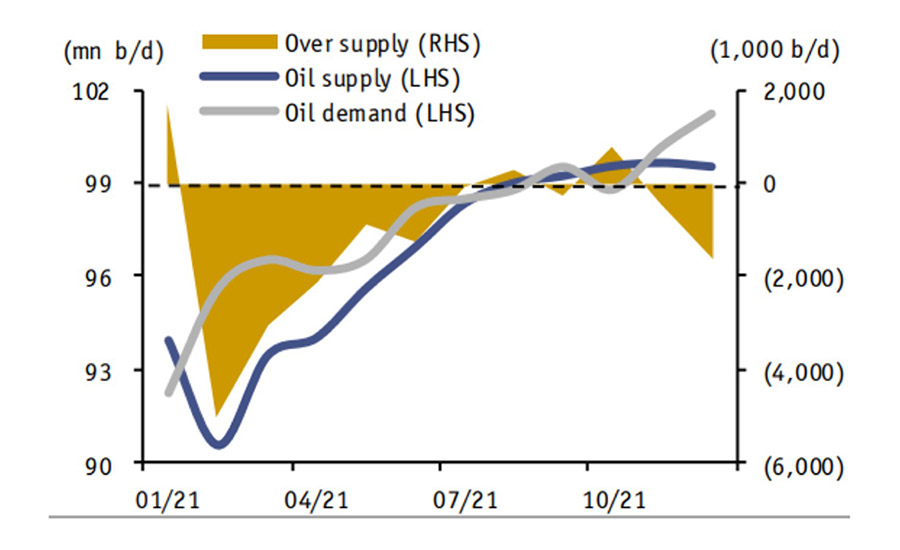

With economic activities returning to normal levels, both WTI and Brent are up around 30% so far this year, on the back of an improved demand outlook due to the successful vaccine rollout. Oil demand has been recovering in China first, followed by the U.S. and Europe, and continues to exceed supply. Conversely, global oil supply declined 6% year over year in April due to oil cuts by OPEC+ members and a production slump in the U.S.

In 2021, oil prices have advanced steadily; on June 1, Brent crude futures breached the $70/barrel ceiling and extended the rise the next day. Pricing is expected to hold strong near term through the 2021 second quarter. However, WTI is expected to slow down to ~$59/bbl in the second half of the year, as petroleum supply disruption in Texas since February is expected to normalize (relieving supply pressure) and OPEC+ normalizes its production level.

Figure 2. Global oil supply and demand, 2012. (Source: EIA)

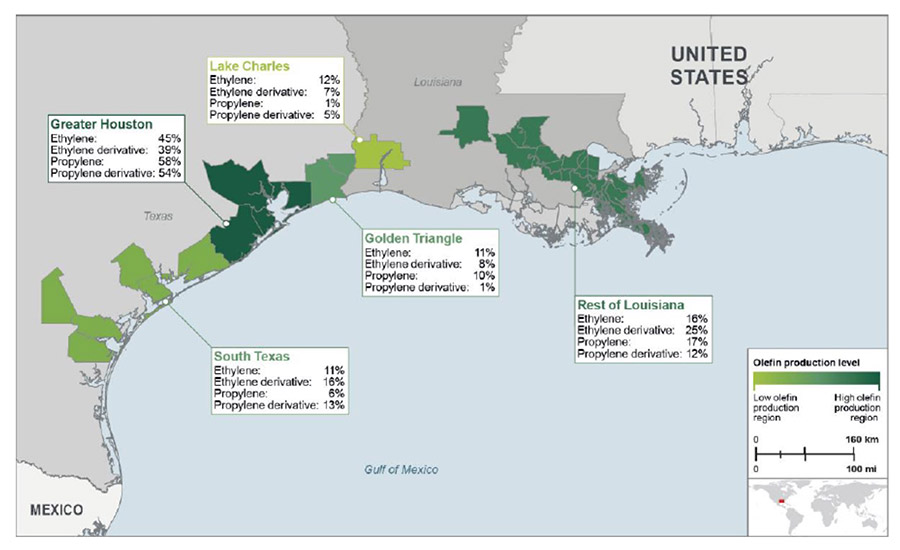

Winter Storm Uri

As Winter Storm Uri hit the Texas-Louisiana area in February, several sites shut down or ran at reduced rates in the chemical industry. Nearly 78% of U.S. ethylene supply had been impacted, shutting down almost every propylene production unit in Texas and several in Louisiana (the Lake Charles area). The industry’s recovery is generally approaching completion, though pricing for raw materials is still inflated.

Figure 3. Production loss (%) in U.S. Gulf Coast light olefins corridors. (Source: IHS)

Raw Material Prices

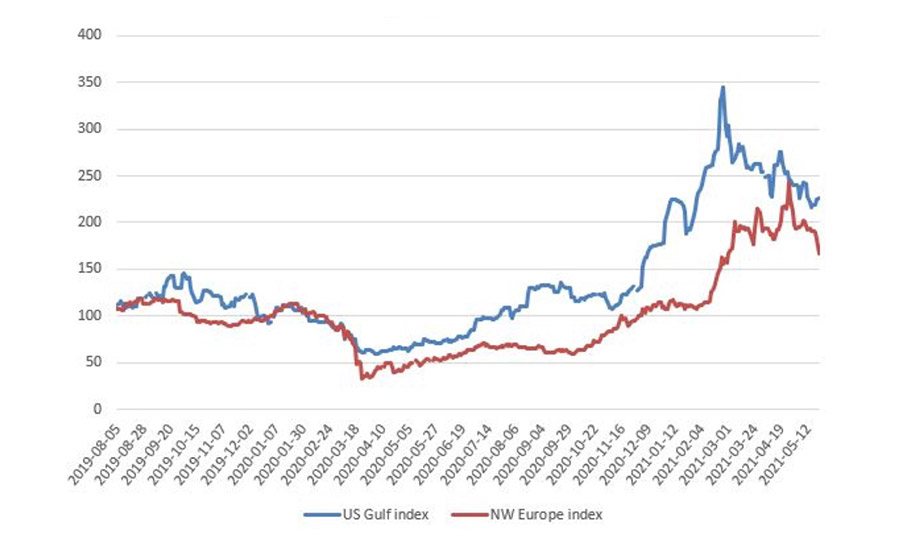

The ICIS Petrochemical Index tracks chemical prices in important value chains and regions. Petrochemical prices that have been up across all regions have recently softened.

The index tracks the movement of prices for the 12 major petrochemicals and polymers: ethylene, propylene, butadiene, benzene, toluene, paraxylene (PX), polyethylene (PE), polypropylene (PP), styrene, polystyrene (PS), methanol, and polyvinyl chloride (PVC), with the regional indexes weighted by capacity. The IPEX values are related to a January 2000 base of 100.

Figure 4. ICIS spot price indexes, August 2019-May 2021. (Source: ICIS)

Ethylene

As production issues related to Winter Storm Uri were largely resolved by the end of March, ethylene chain fundamentals remained tight in April on strong demand. Effects from the storm linger as the market continues to work through the impacts of lost production, which pressured already-tight markets and planned maintenance.

In addition, with strong packaging demand and new derivative capacity startups, ethylene contract prices moved higher for the fifth consecutive month in April (47.25 c/lb). On a brighter note, as supply disruptions end, real underlying supply and demand are likely to become more balanced, reducing the pressure on price inflation.

Lastly, while the rest of the world looks to Asia to consume excess ethylene, Asian demand will heavily rely on global control of COVID-19. This is particularly true with surges in other regions that pressure derivative export volumes.

Propylene

Propylene prices settled down 19% in April to 57.0 c/lb and 55.5 c/lb for chemical-grade (CG) and polymer-grade (PG) propylene, respectively. Supply conditions improved as U.S. propylene capacity came back online following widespread outages in late February due to Winter Storm Uri.

Propylene prices remain well above their three- and five-year averages (41 and 40 c/lb, respectively, for chemical-grade propylene), due to rebounding downstream demand, higher oil prices, and low inventories.

Vinyl Acetate Monomer

Vinyl acetate monomer (VAM) prices have increased significantly amid a global supply shortage. News of additional outages and strong downstream demand (adhesives being one of the primary determiners driving demand) are leading to expectations of further pricing increases.

Wacker Chemie’s chief finance officer called the more than doubling of VAM prices “crazy” on a recent earnings call. Unfortunately, continued export strength and robust construction sector demand are anticipated to keep prices elevated.

Butadiene

Global butadiene demand is expected to continue to recover throughout 2021, in line with increasing downstream tire and vehicle production. Asia is a key player in the global butadiene (BD) market, accounting for more than 62% of global consumption. It is also the world’s largest BD producer, churning out nearly 59% of global output.

CFR China butadiene price was up recently, with the butadiene-naphtha price spread being pushed up to a five-week high. However, sources have indicated that this price increase may be limited amid increasing supplies from China, as China has been accelerating butadiene exports in line with rising production capacities.

In the U.S., market participants see continued strength in pricing through the second half of 2021 due to the ongoing curtailment of supplies following TPC Group’s explosion at its butadiene unit at Port Neches, Texas. There will be many challenges for butadiene supply, and the U.S. will need to compensate through imports as automobile demand spikes.

Styrene

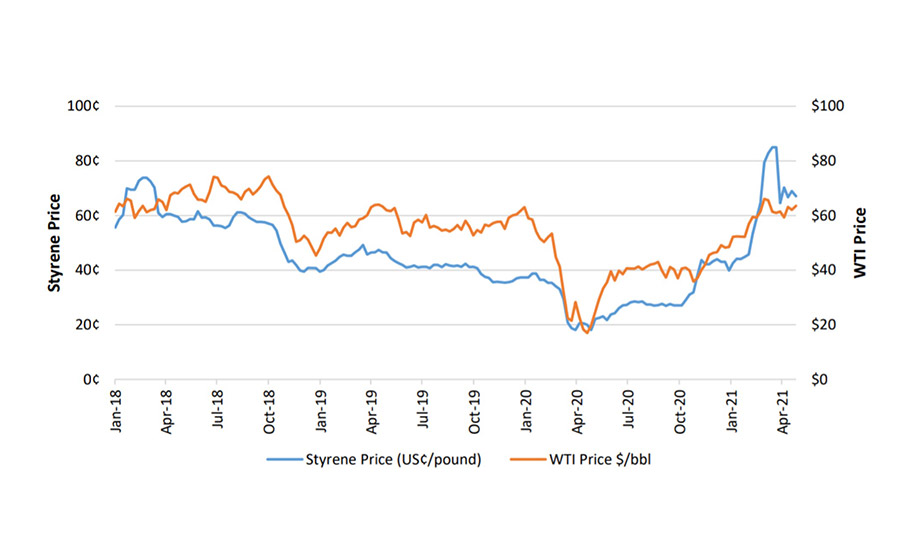

Figure 5. Styrene and oil prices, January 2018-April 2021. (Source: Bloomberg)

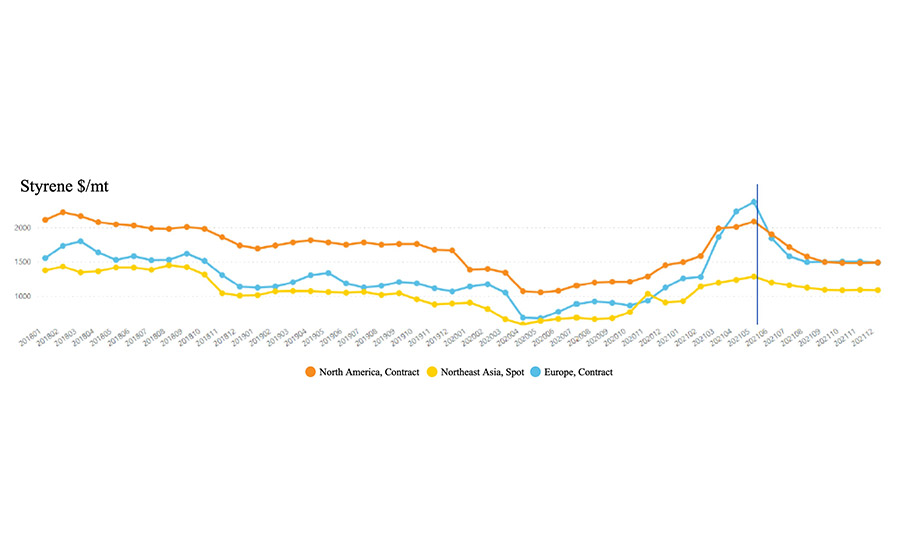

Figure 5 shows styrene and oil prices since 2018. The relationship between styrene and oil prices has returned after briefly breaking down due to the winter storms in the southern U.S. that interrupted petrochemical production. Styrene experienced a sharp increase early this year (~ 30%), but has subsided and is expected to moderate until the end of 2021 (see Figure 6).

Figure 6. Styrene pricing, 2018-2021. (Source: IHS)

For more information, call (513) 469-7555 or visit www.chemquest.com.

Note: Opening image courtesy of banjongseal324 via iStock/Getty Images Plus.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!