Strategic Solutions

COVID-19 Impact on Global Shipping and Packaging Dynamics

The continued transition away from brick-and-mortar to ecommerce brings demand for packaging innovations that enable faster delivery and better content protection from shock or temperature variations.

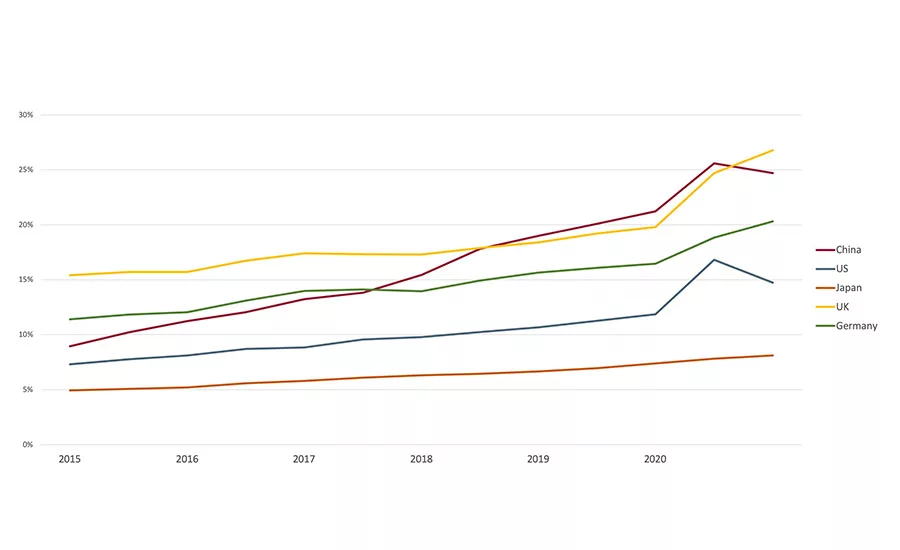

Figure 1. The share of ecommerce in overall retail sales has spiked.

(Sources: JP Morgan, Statista.)

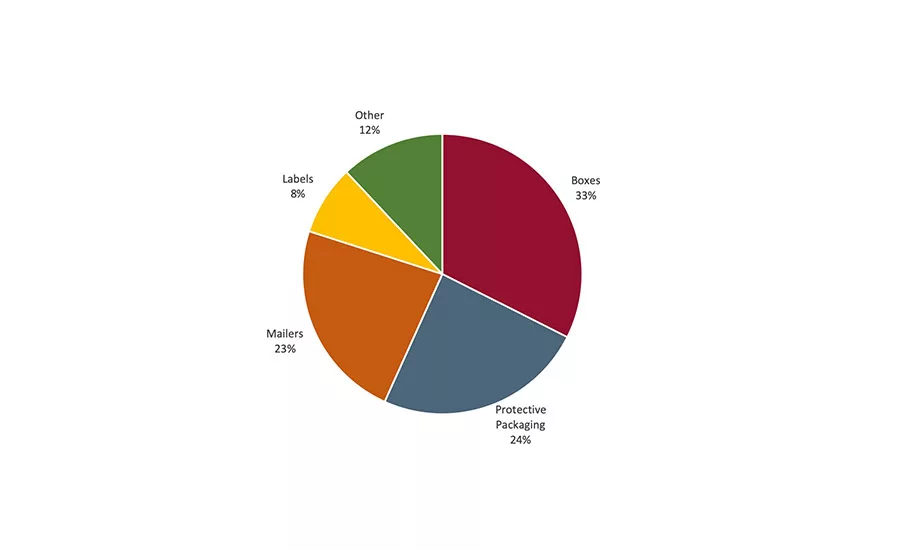

Figure 2. Global ecommerce packaging demand by product.

(Source: Freedonia.)

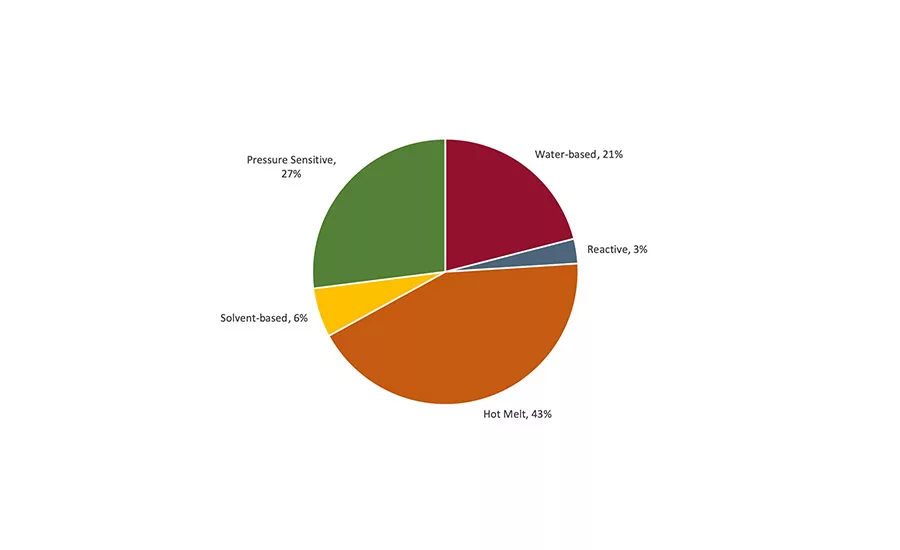

Figure 3. Flexible packaging adhesives by technology in North American paper, board, and related products.

(Source: The ChemQuest Group.)

The shift from brick-and-mortar to digital shopping had been under way for some time when the COVID-19 pandemic hit. Since 2017, ecommerce revenues have risen from an estimated $1.4 trillion to $2.4 trillion, or about 2.7% of global output.

China is the largest market, followed by the U.S., Japan, the UK, and Germany. The pandemic has further accelerated this shift. The restrictions on mobility imposed to fight the spread of the virus led to a surge in online demand for many goods and services. As individuals stayed home, the online share of retail sales in China, Germany, the UK, and U.S. rose by 4-7 percentage points in 2020. In China and the U.S., the share has recently fallen again but remains well above its pre-pandemic level.

COVID-19 has accelerated the shift toward digital living and ecommerce. As ecommerce continues to gain prominence, more emphasis is being placed on packaging’s role in this new era. With this transition comes demand for packaging innovations that enable faster delivery and better content protection from shock or temperature variations.

Packaging Supply Chain

COVID-19 represents a game changer for the packaging industry. The pandemic has suddenly created among consumers a general need to feel safer from diseases, particularly those that are virally transmitted. Consumers are required to spend more time at home and less time socializing in public. Safety and hygiene have suddenly become paramount, and digital convenience has also risen in importance.

The pandemic has increased not only packaging demand but its prominence. Packaging has gained value in the eye of the shopper, which, in turn, drives innovation and may improve margins for the packaging industry.

Specifically, consumers greatly value packaging’s preservation properties, the hygiene and safety offered by packaging against viral contamination risks, and the convenience of packaged goods delivered through ecommerce as a safer alternative to in-store shopping. Thus, opportunity in packaging innovation can serve consumers in the future in three main ways:

- Improving hygiene and safety—shelf life optimization, antimicrobial packaging, smart packaging connected with contact tracing apps, and low-touch/contactless packaging

- Improving environmental sustainability—more widely recyclable packaging materials, more recycled content usage, more bio-based and compostable/biodegradable materials, and new returnable systems

- Getting ecommerce ready—new shockproof and insulation packaging, new pack formats and sizes for home or letterbox delivery, new pack formats for greater automation and turnaround, and favorable unboxing features for package recipients

Packaging material and technology advances will be a significant part of the future of packaging, with the two-pronged goal of increasing consumer engagement with a brand and augmenting the connectivity to the product itself. For example, radio frequency identification (RFID) can allow tracking on a package and sends signals to a smartphone. This technology also will allow brands to monitor certain conditions during the journey, such as temperature, vibration, and security.

Packaging Adhesives

Ecommerce packaging adhesives must be compatible with the latest intricate packaging designs while remaining safe and reliable on complex commutes, factoring in cost pressure through the value chain. Adhesive manufacturers now must keep pace with both the retailer and the rapidly changing demands of consumers, such as tamper-evident seals and returns of pre-packaged goods. Adhesive manufacturers should pay attention to four potential packaging changes to be competitive in the post-COVID milieu:

Decreased Importance on Packaging Shelf Appeal

According to McKinsey & Co., some analysts speculate that using a product’s packaging to attract customer interest will not be as important as it has been in traditional retail. This is because a product will not be on a shelf among many other products vying for consumer attention. Graphics and aesthetic package design may hold a lower priority in primary and secondary packaging structures.

New Package Development Opportunities

Ecommerce will create an opportunity for new types of packaging to be developed. Forecast to be in demand are: packaging that uses materials durable enough for shipping process, and packaging that does not require both primary and secondary packaging to ship.

Increased Production Line Optimizations

Packaging that can be filled quickly and inexpensively on production lines will likely gain prominence. Package manufacturers will want to ensure they use materials suited for automated equipment that does not contribute to downtime or product quality issues.

Specialized Packaging Designs

Packaging developed specifically for ecommerce is also likely to make headway in upcoming years. This entails packaging that is lighter weight and smaller in size to help reduce shipping and storage costs, as well as packaging that is right-sized and uses less material to aid in sustainability initiatives.

When shopping online, the customer’s first touchpoint with a brand is often its product’s packaging. Adhesive manufacturers must work closely with global brand leaders to ensure that the adhesive holds the package together effectively and can easily be applied neatly so as not to interfere with the first impression of the end product.

The focus is now also on more sustainable ecommerce packaging solutions. A news report revealed that in 2021, not only will 67% more Americans shop online but 68% will look for plastic-free packaging. Natural polymers are ranked as the number-one disruptive technology, followed by hot-melt adhesives emerging on the market with bio-based content of 25-75%. It is considered to have significant potential in fast food/ grocery packaging due to sustainability implications and consumer behavior.

Understanding Future Trends

Looking to 2024, all consumer goods industries and their packaging should boast a positive CAGR as the effects of the COVID-19 pandemic recede and the economy slowly recovers. Beyond 2021, the impact of high government and private sector debt, coupled with a slowing economy (after pent-up demand has receded), will likely slow growth.

Access to market research by end market will allow adhesives stakeholders to assess by market segment. Factors such as product demand, technology share, material performance, growth drivers, and unmet market needs will help better target profitable innovative R&D programs.

For more information, call (513) 469-7555, email info@chemquest.com, or visit www.chemquest.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!