Output of U.S. Chemical Producers Grows 3.9% in 2022, ACC Reports

Image of a market graph

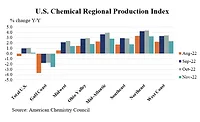

According to the American Chemistry Council’s (ACC) new report, titled Year-End 2022 Chemical Industry Situation and Outlook, the chemical industry posted one of its best years in a decade. Additionally, the United States expanded its dominant position as a leading producer of chemical products, but growth has slowed in recent months.

“We anticipate a shallow recession beginning in early-2023 followed by recovery in the latter part of the year,” said Martha Moore, ACC chief economist and author of the report. “Weak demand in the United States and abroad will weigh on U.S. chemical producers, but chemical manufacturing in the United States will continue to enjoy a competitive advantage on the strength of domestic energy production.”

With a reportedly strong start earlier in the year, output of U.S. chemical producers grew by 3.9% in 2022, but chemical output is expected to fall by 1.2% in 2023. Chemical industry employment surpassed pre-COVID levels in January, and payrolls grew by more than 15,000 workers in 2022. Following an expected decline in 2023, job growth will pick up in 2024 and increase over the next two years. Chemical workers continue to be among the highest paid in the manufacturing sector – averaging more than $90,000.

Chemical industry capital spending grew 9% to $33.5 billion this year with higher spending on capacity expansions, upgrades, and sustainability projects – including significant investments in lower emissions technologies and advanced recycling. Growth in capital spending is expected to slow to 3.6% next year.

U.S. chemicals trade rose 22% in 2022, hitting a record high of $342 billion. Both exports and imports rose considerably, also reaching historical highs. According to the ACC report, U.S. chemicals trade growth will be limited in the coming year by weaker growth in the U.S. economy and in external markets. Overall, chemical exports are expected to fall 9.3% in 2023 due to slowing growth but should recover, reaching $193 billion by 2026.

Prepared annually by ACC’s Economics and Statistics Department, the Year-End 2022 Chemical Industry Situation and Outlook is the association’s review of the U.S. and global business of chemistry and the macroeconomy. It offers global and domestic chemical industry data related to production, trade, shipments, capacity utilization, end-use markets, R&D spending, capital spending, and employment and wages.

The full report can be accessed here.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!