MarketTrends

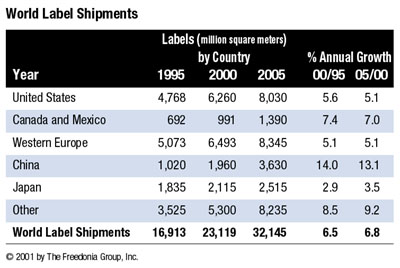

World Label Shipments to Grow Nearly 7% Through 2005

The best gains are expected in the world's emerging economies, which already account for almost one-third of global label production. China will experience explosive growth, surpassing Japan as the second leading label-producing nation after the United States. Eastern Europe will also log double-digit annual gains as greater self-sufficiency in label production is achieved. Label markets in East Asia and Latin America will enjoy robust growth as well, fueled by rapid economic expansion, rising populations and expanding consumer sectors increasingly able to satisfy their desire for foods, beverages, personal-care items and other highly packaged consumer products.

Pressure sensitive labels, which surpassed wet glues as the leading label type in the late 1990s, will account for 54% of the global market by 2005. Newer label types like sleeve, in-mold and heat-seal filmic wraparounds will also capture a larger share of the market, albeit from a slim 2000 base, logging double-digit annual gains in most countries.

Plastic labels will cut more deeply into traditional paper applications, capturing 27% of the world market by 2005. Technological, financial, aesthetic, performance and environmental considerations will all favor the use of plastic over paper substrates. Flexography, which is already the dominant label-printing technology in the developed world, will make rapid gains in the developing markets at the expense of letterpress and (to a lesser extent) other printing technologies (offset lithography, gravure, screen). Moreover, the nascent market for digital label presses - 200 or so were in place worldwide in 2000 -- will expand rapidly in the new decade.

The 336-page World Labels study is available from The Freedonia Group, Inc., 767 Beta Dr., Cleveland, OH 44143-2326; phone 440-684-9600; fax 440-646-0484; or e-mail pr@freedoniagroup.com. Or Circle No. 71

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!