MARKET TRENDS: Emulsions

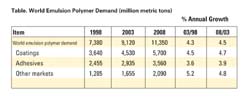

World emulsion polymer demand is forecast to increase 4.5% per year through 2008 to 11.4 million metric tons, a result of healthy economic growth prospects in much of the world. Market value is forecast to rise 6.1% per year through 2008 to over $24 billion, benefiting from shifts in product mix toward higher priced emulsions, particularly acrylics. Though emulsion polymers are highly versatile and used throughout the industrial economy, the market will remain closely linked to a relatively narrow group of products, most prominently waterborne paints, paper coatings, and general-purpose adhesives.

These and other trends are presented in World Emulsion Polymers, a new study from The Freedonia Group Inc., a Cleveland-based market research firm.

North America and Western Europe accounted for 65% of global demand for emulsion polymers in 2003. In addition to dominating worldwide output of key emulsion-containing products such as latex paints, coated paper and general-purpose adhesives, suppliers in these regions have made the greatest efforts to improve the environmental compatibility of their offerings. Nonetheless, the most rapid gains in emulsion polymer demand through 2008 will arise in developing regions, especially Asia. Rapidly developing countries such as China and India have only recently begun the move from solvent- to waterborne paints.

Demand for emulsion polymers in adhesives will benefit from solid demand in the paper and paperboard packaging materials sector, as well as in the tapes and labels sectors. Volume demand will continue to be dominated by low-cost polyvinyl adhesives used in high-speed packaging processes, particularly paperboard cartons. However, sluggish gains in carpet-backing applications, where SB latex predominates, will be a drag on the segment. Among the remaining markets for emulsion polymers, strongest gains are forecast for printing inks (which are also seeing a shift to waterborne formulations), and sealants and caulks.

For more information, contact Corinne Gangloff, The Freedonia Group Inc., 767 Beta Drive, Cleveland, OH 44143-2326; phone (440) 684-9600; fax (440) 646-0484; e-mail pr@freedoniagroup.com ; or visit http://www.freedoniagroup.com .

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!