Spectroscopy Scope

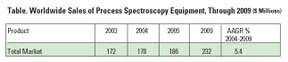

According to a report from Business Communications Co. Inc., RG-228R The Process Spectroscopy Market, the total worldwide market for process spectroscopy instrumentation is expected to grow from $178 million in 2004 to $232 million in 2009, at an average annual growth rate (AAGR) of 5.4%. The market includes monitors operating in the ultraviolet and visible portions of the spectrum, dispersive near-infrared analyzers, Fourier transform instruments operating in both the near- and mid-infrared portions of the spectrum, Raman spectrometers, and other instruments providing spectral information not in these four categories.

Near-infrared monitors are expected to constitute the largest segment of the market in 2009, with sales of $71 million. This figure is expected to result from increased sales due to the Food and Drug Administration Process Analytical Technology (PAT) initiative, which seeks to streamline drug manufacturing processes.

The highest rate of growth of any instrument type is expected among Raman spectrometers, with an AAGR of 8% over the forecast period. Long considered an academic technology, Raman has in recent years made significant inroads into process monitoring in tasks for which the technique is very well suited. Raman's expected validation as a PAT technique is thought to be a significant factor in its growth.

The largest application market for process spectrometers will continue to be in chemical and polymer manufacturing, with $50 million in sales forecast for 2009. The worldwide nature of this industry, and spectroscopic instruments' long heritage in monitoring its processes, contribute to high sales volume. The market for process instruments in pharmaceuticals is expected to have the highest AAGR of any application - 9.4%, over the forecast period. Sales into pharmaceutical markets are forecast at $45.5 million in 2009, making this market second in value only to the chemical and polymer industry.

Several trends were seen to influence market growth and dynamics. First was the increasing tendency on the part of UV and visible systems manufacturers to develop cheaper, more portable versions of their high-end systems in response to competition from miniature spectrometers sold into the highly fragmented UV and visible market. Development of lower-cost Raman devices was seen as well. Near-infrared and Fourier transform instruments did not see significant competition from portable devices. High-end systems, particularly in the near-infrared, continue to dominate many process markets.

New technologies, however, have the potential to change that situation. Micro-electro-mechanical-systems (MEMS) technology offers the potential to make "spectrometry on a chip" become a viable option for process monitoring, if not during this forecast period, then shortly afterward. MEMS devices have already been used in a portable near infrared (NIR) system. Acousto-optic tunable filters, which provide rapid and repeatable wavelength selection without the use of moving parts, are being produced commercially and are employed in NIR systems that sell in the $45,000 range - considerably cheaper than most NIR monitors. These two technological trends -increased used of MEMS and lower cost filters for NIR devices - are seen as indicators that, in 10 years, the process spectroscopy market may be significantly different from today's market, with cheaper and more portable systems operating in many manufacturing applications.

Also important to process spectroscopy instrument sales is the continued movement of manufacturing industries to offshore locations. New plants need hardware, and process spectroscopy monitors can realize increased sales in many overseas locations.

For more information, contact Business Communications Co. Inc., 25 Van Zant St., Norwalk, CT 06855; phone (203) 853-4266, ext. 309; e-mail publisher@bccresearch.com; or visit www.bccresearch.com/press.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!