STATE OF THE ADHESIVES AND SEALANTS INDUSTRY: A Recovery is in Sight

Raw Materials

The most immediate challenge to adhesive and sealant manufacturers in 2005 is curtailing a wave of raw material increases. Manufacturers face double jeopardy stemming from industrial chemical prices reaching record levels due to the partial pass-through of higher oil and natural gas prices. Natural gas prices are likely to remain well above historical levels, which will keep industrial chemical prices from falling sharply when oil prices recede.

Growth

Growth is expected to slow going into 2005 as high energy prices pull down consumer spending by eating into discretionary expenditures. While prices of commodity and intermediate materials have risen sharply, prices of finished goods have moved up relatively little, thus leading to a high degree of uncertainty about higher inflation in the pipeline due to such disparity.Capacity utilization in manufacturing is on the rise from 20-year lows - at approximately 75% - but is well below the pre-recession levels of mid-80 percentiles. Manufacturing production is somewhat sluggish and is expected to remain weak for the next several months. If oil prices continue their decline, stronger growth should resume in late 2005.

The China factor plays an important role for manufacturing. China is a heavy influence on commodity pricing as the country continues its rise in the ranks of global economic powers. China's production growth continues at a double-digit clip despite its government's efforts to slow down the economy. Growth in China is so strong that China has joined the United States as a locomotive for global growth. China has grown to become one of the world's largest consumers of many commodities; though contributing nearly 5% to global industrial production, China consumes over 20% of world materials for infrastructure expenditure and manufacturing growth.

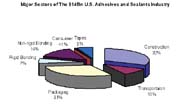

Seven major sectors define the $14 billion U.S. adhesives and sealants industry: construction, packaging, transportation, rigid and non-rigid bonding, consumer, and tapes. The top three sectors represented by construction, packaging and transportation drive the industry with a combined 73% share of market.

Construction activity should remain strong. Housing starts remain near their highest levels despite the recent Federal Reserve activity in raising its target federal funds rates. While housing starts are in a slight decline, they remain near their record highs. Likewise, existing home sales are expected to remain strong as mortgage rates are once again declining. The prognosis is that housing will continue to support consumer spending over the next few months, as homebuyers furnish their new homes.

Packaging is one of the most mature sectors and is likely to show modest gains as industrial production ramps up. The flexible packaging portion, however, is projected to grow in excess of 5% annually. Gains will occur from continued conversions from rigid packaging materials (such as cans) and an increase in consumer purchases as consumers stay at home more with their discretionary spending under pressure.

Industrial production of motor vehicles was at record levels in the beginning of 2004, but declined going into 2005 as dealers began working off excessive inventories. Annual sales and production in 2005 are expected to remain even with 2004 levels.

Globalization

Globalization will open new markets abroad for large multinational manufacturers, but creates significant problems at home for multinational and regional manufacturers. The challenge is manifested in the realignment of manufacturing via a loss of business to emerging low wage economies (e.g., China, India, and Vietnam), leading to ever-increasing competition for a shrinking piece of the pie.Consolidation

Nearly three quarters of the adhesives and sealants industry is considered mature, albeit still very highly fragmented. As such, growth challenges encourage companies to look for acquisitions as a means of advancing their position in technologies and markets. The demographics of adhesive and sealant manufacturers in the U.S. are rapidly evolving to a two-class structure. Medium-sized manufacturers have nearly become extinct; Sovereign Specialty Chemicals is becoming the most recent casualty with its impending sale to the global giant Henkel (the deal was expected to be completed by the end of 2004).There is an order of magnitude in disparity in the adhesives and sealants industry between the handful of large manufacturers with revenues typically exceeding $700 million and approximately 300 smaller manufacturers with sales typically below $50 million. Smaller manufacturers lack the critical mass to sustain their competitiveness and face elimination unless they redesign their structure and offerings to provide differentiated products and services.

Penetrating New Applications

The beauty of the adhesives and sealants industry is the continual evolution of opportunities from new applications. This industry is quite old, yet it continues to track above GDP growth on a regular basis. While the low- and middle-hanging fruit are fairly well plucked, growth opportunities brought about by a shift from mechanical fasteners are ample. As a component of the joining industry on a macro level, adhesives and sealants represent less than ten percent penetration against major forms of industrial joining like welding and mechanical fastening.Major trends favoring a shift to adhesives and sealants include the following.

The industry faces many challenges in its efforts to displace well-trenched and fairly ubiquitous competitive joining materials.

- Education and awareness of end users to reverse a negative perception that adhesives and sealants are low-cost and less-reliable methods of joining

- Innovation of new assemble- and disassemble-on-demand technology that will enable the use of adhesives and sealants in applications requiring repairability and serviceability of components

- User friendliness in manufacturing operations. Adhesives and sealants are perceived as messy and requiring special handling. End users give a distinct advantage to pressure-sensitive tapes in this regard.

In the end, we believe 2005 holds out good hope for adhesive and sealant manufacturers. Aside from high energy prices and the threat of terrorism, the global economy is relatively free of the stresses and imbalances that would normally end an economic expansion. Correspondingly, margins are expected to recover as manufacturers work feverishly to pass through raw material costs.

For more information, contact The ChemQuest Group Inc., 8150 Corporate Park Drive, Suite 250, Cincinnati, OH 45242; phone (513) 469-7555; fax (513) 469-7779; or visit http://www.chemquest.com .

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!