STATE OF THE ADHESIVES AND SEALANTS INDUSTRY: Pressure-Sensitive Tape Manufacturers Optimistic

Pressure-sensitive adhesive tape manufacturers are optimistic for 2005. Acknowledging they will face raw material challenges, manufacturers look forward to the new year and expect their industry will be paced by the growth experienced in key tape markets and a continuing solid economy.

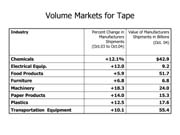

At the recent PSTC Annual Meeting, the companies representing the industry commented on their experiences. Manufacturers feel that in 2005 the strongest growth will occur in specialty tapes and advances in product material designs that are positioning tape as the preferred bonding and fastening system in many industries. The tape industry's 2005 growth will parallel the forecasted 2005 gross domestic product (GDP) growth of 3.4% (real non-inflationary growth). It is interesting to note that there is major international ownership interest in U.S. manufacturing as globalization of manufactured products continues to grow.

The tape industry faces the same raw-material supply shortage challenges as its customers and other United States manufacturers, in addition to issues caused by increased pricing. These shortages are now reaching into Europe and Asia as well. Tape manufacturers and customers have to manage production schedules based upon allocation of raw materials supply. The tape industry will work through this new hurdle by building stronger channel support from supply through sales. In addition, company research and development departments are working overtime to seek alternative supplies and new product opportunities. Rising fuel costs add to the burden as trucks are utilized to move freight throughout North America.

Additional challenges include adjusting for manufacturing capacity that is greater than demand, thus forcing competitive pricing of commodity products. This is particularly true in the retail segment where powerful buyers are resisting the price increases needed to recover raw material cost escalation.

In a major shift from three years ago, capital goods manufacturers serving the tape industry have full order books for equipment. It will be hard to purchase and take delivery of manufacturing equipment within the next 12 to 18 months as tape manufacturers look to investment as a means of decreasing costs and protecting competitive markets.

Economic Indicators Provide Guide

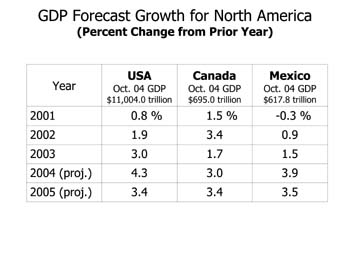

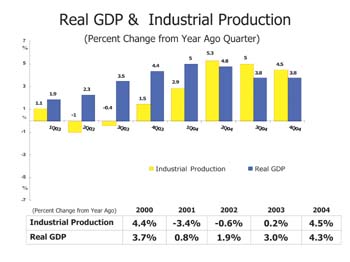

PSTC economist John McDevitt presented several interesting charts at the PSTC meeting. Retired from 3M in 2001, McDevitt continues to offer regular economic briefings to help guide top management.The $12 trillion North American GDP (U.S, Canada, Mexico) represents 47% of the global economy. GDP is the sum of all goods and services in the economy - from haircuts and steel to cars and tape. The North American Free Trade Agreement (NAFTA), now 10 years old, merged these three markets into one.

The GDP is forecasted to slow in 2005 after growing 4.3% in 2004 (see Figure 1). Our neighbor, Canada, is expected to grow, while Mexico will follow the United States in a small downturn. Despite the weakening U.S. economy, the industrial sectors where tape is used that will remain strong include semiconductors, processed foods, rubber and plastics, auto, and electrical machinery. The mining and petroleum industries will also be strong performers.

For more information on the PSTC, visit http://www.pstc.org .

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!