STATE OF THE ADHESIVES AND SEALANTS INDUSTRY: Industry at a Crossroads

As we approach the halfway point in the first decade of the new millennium, the adhesives and sealants industry stands at an exciting crossroads. On the one hand, the industry shares many of the sobering challenges faced by other sectors of the North American chemical industry. Such issues include the following.

- Increasing prices. It's the new reality that a large number of adhesive companies are being forced to raise prices to help offset run-ups in raw material pricing. Feedstock pricing continues to rise, impacted by escalating costs of crude oil and derivative petrochemicals, which are also impacting availability of key monomers in some markets.

- Declining profits. Companies are faced with rising raw material prices, higher utility rates (natural gas pricing continues to climb as well), and increases in overhead costs such as health insurance and environmental/regulatory compliance.

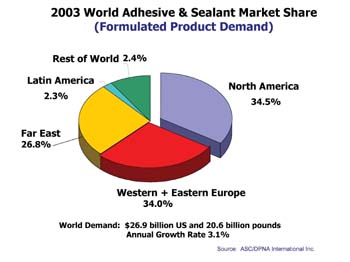

- Globalization of customer base. Entire customer bases have migrated to Southeast Asia. Furniture and textiles are just two examples. Couple this with the dizzying pace of China's economy (is India next?) and it becomes clear that companies that want to achieve true organic growth must go where the customers are. More and more companies are playing in the international arena, yet must compete with the realities of low-cost regional foreign companies, which have a leg-up on their U.S. counterparts due to significantly lower wage rates and the absence of many regulatory and other overhead costs that American firms must bear.

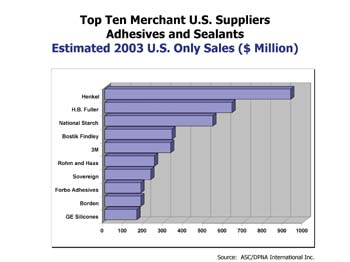

- Industry consolidation. Today, perhaps spurred on by the prospect of a strengthening economy, the industry is beginning to see increased M&A activity, which appeared to have taken a hiatus over the past several years. Larger players, many flush with cash, are acquiring smaller and mid-sized formulators to bolster market share and complement their existing technology portfolios.

On the bright side, however, opportunities to replace mechanical and other fasteners with adhesives and sealants do exist. Never before has there been a broader array of product formulations and new chemistries available to the product designer. However, one of the industry's challenges lies in how effectively it can communicate and educate different generations and future designers, engineers, and architects who have no formal training in adhesives, and who harbor various misperceptions about our products. To remedy this condition, the industry must develop and promote new training tools to help its customers feel more comfortable and secure in selecting adhesives and sealants as the preferred bonding alternative. In addition, the industry must address the longer-term realities of little formalized training in undergraduate engineering programs to educate the next generation of designers. This grassroots work is crucial in helping to grow the industry.

Current Market Conditions

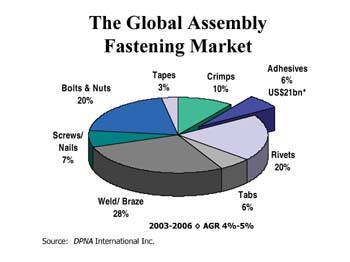

Let's first examine the global fastening market (see above). It is valued at some $350 billion, of which adhesives and tapes account for just 9% of the total demand. Of this, adhesives account for $21 billion. Annual growth rates are forecasted at 4-5% through 2006.

A Look Ahead

Finally, looking ahead, there are several emerging technologies that present exciting growth opportunities. These include the following.- Radiation cured

- New thermoset hot melts

- Reactive urethane dispersions

- Structural tapes

- Multi-step cure

- Inorganic polymer-based adhesives

- Multi-purpose adhesives

For more information on the ASC, visit http://www.ascouncil.org .

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!