Staying Ahead of the Curve

Finding novel uses for existing materials can catapult your portfolio into new markets.

With increasing competition on a global scale, it can be challenging to position both new and existing products for ever-growing market share and, more importantly, to diversify into new markets that provide a hedge against economic fluctuations. Following are two major lessons our clients have learned that may benefit other suppliers.

Finding New Uses for Old Materials

A time-tested strategy for market diversification and staying ahead of the curve involves periodically assessing the value of your portfolio against today’s customer requirements by application area. Your portfolio likely consists of some mature products that have succumbed to commoditization. How can you differentiate a commoditized product to increase market penetration and margins, permanently escaping the “price-only” death spiral?

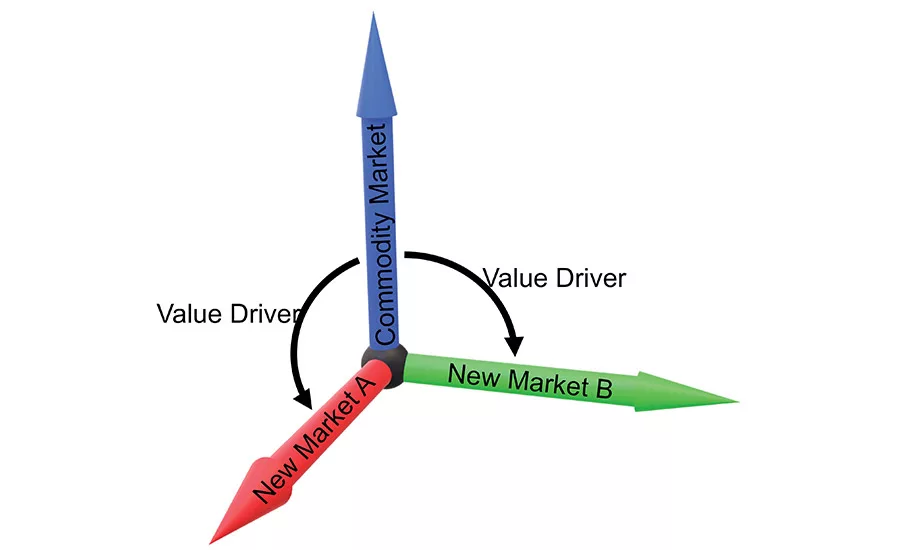

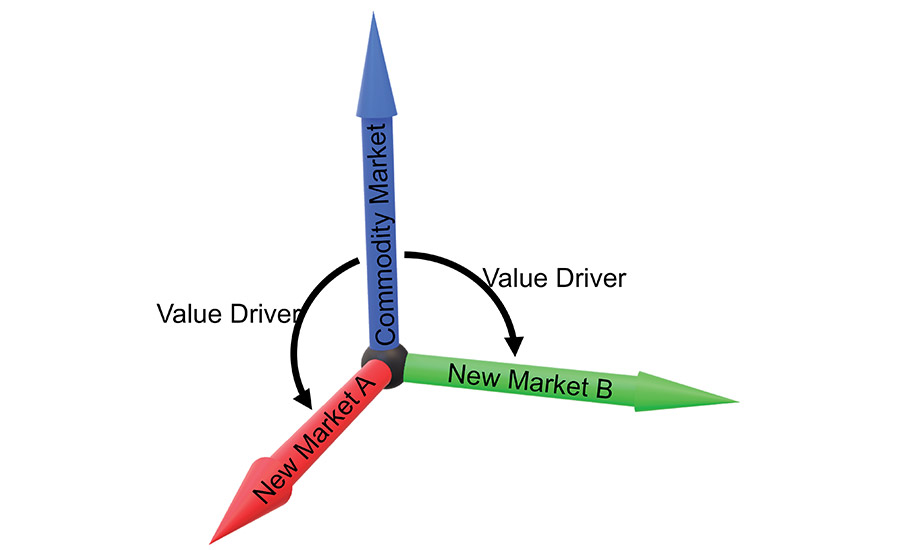

Differentiation can be a tough nut to crack. Many companies bring additional value through branding and improved service, which is indisputably an important part of the mix. The game changer, however, is finding a novel use for a mature material to serve as a successful springboard to orthogonal markets. An orthogonal market is an unrelated market that exists outside the dimension of your current market, as depicted in Figure 1.

Figure 1. Finding new uses for old materials.

To this end, we advise a three-pronged approach: uncovering hidden value to achieve higher margins; expanding the market potential of an existing product; and revitalizing dead intellectual property and potentially lifting your product out of commoditization for the remainder of its lifecycle. This sounds good on paper, but how exactly do you execute such a strategy? Indeed, you may be reminded of the adage “it’s hard to schedule discovery.” Discovery begins with fresh eyes viewing the challenge from every potential angle. Bringing in cross-disciplinary teams that have deep-domain experience in unrelated industries can mean going outside your four walls.

For example, we discovered that a raw material intended for fortification of adhesives had novel optical and rheological properties that expanded its use into a variety of coatings applications. We were only able to realize this material’s novel potential because we had both adhesive and non-adhesive experts examining the material from their unique perspectives.

Don’t Make Your Customers Guinea Pigs

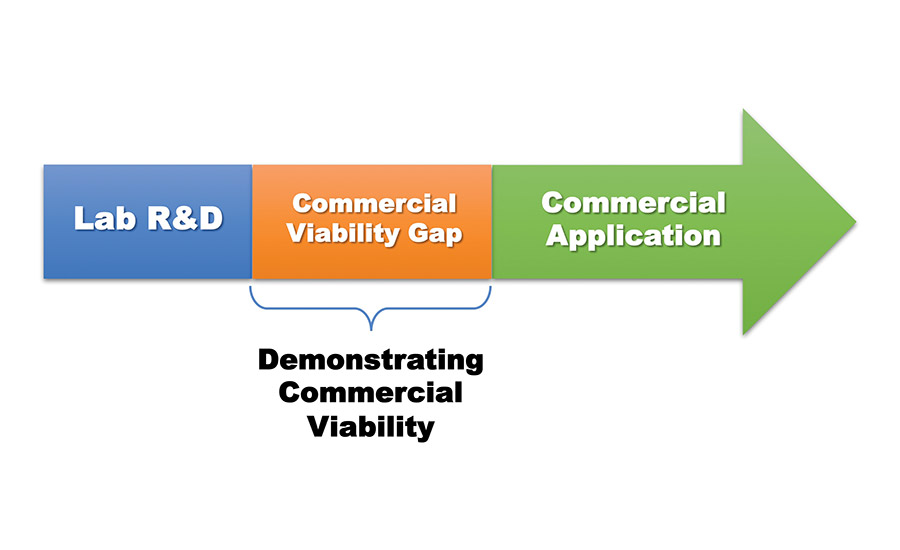

What is the formula for a successful product launch that maximizes adoption among customers and margins while minimizing risks? Is fully demonstrating commercial viability before launching your products to customers profitable? A common mistake we’ve observed across the value chain—whether it is a raw material supplier to a formulator or a formulator to an end user—is engaging the customer too early in the adoption process, only to have the material fail in the customer’s hands. Or the customer deems it as too costly to fully integrate due to requiring too much upfront development.

Often, a supplier is afforded only one opportunity to make a good impression on an important customer. Therefore, making your customer a guinea pig is a high-risk, low-reward proposition. Figure 2 illustrates the commercial viability gap we have observed in industry.

Figure 2. Commercial viability gap.

To avoid this problematic issue, consider testing new materials in a simulated environment that comes as close to the customer’s environment as possible. If the customer is an OEM, conduct trials and optimize the application of the material on simulated manufacturing equipment at pilot-scale on real parts. If the customer is a formulator, test and optimize the material under the conditions in which the product will be integrated and formulated as the final product. Early trials will ensure that material failures under certain conditions occur in a controlled environment with signed NDAs in place, unbeknownst to customers.

With respect to environmental conditions, have you considered real-world variations in temperature and humidity under which your material might be applied in the field or in the factory, especially as these conditions vary by geographic region? Successfully integrating your product for adoption on a global scale largely depends on its performance in a range of high and low temperatures corresponding with an equally broad range of high and low humidity conditions.

Is your product undergoing testing using the many types of curing technologies on the market to uncover possible performance issues or variations that your customer may encounter? Have you engaged experienced applicators to measure application variations in the field? Our clients have indicated their research protocol is rarely, if ever, this robust; yet, in our experience, such an investigation is easy to implement, accelerates the product adoption curve, and ultimately differentiates a supplier from the rest of the pack—in most cases earning third-party certifications and approvals. ASI

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!