2021 Raw Materials and Chemicals Roundtable

How are suppliers of raw materials and chemicals navigating the multiple diverse challenges that have impacted the industry over the past year?

Before 2020, I always thought it would be fascinating to live through a truly “historic” time. The massive losses of the past year—both human and economic—have cured me of that naïve perspective. However, the continued upheaval has also shown how resilient, supportive, and innovative we can be in the face of multiple crises.

Though many of our businesses have been considered essential since the beginning of the pandemic, the adhesive and sealant industry has certainly not been immune to COVID-19. A sampling of the challenges we’ve encountered includes: multiple shutdowns, occurring at different times and to varying degrees around the world while also impacting demand differently according to end-use markets; wide-reaching production changes to help meet urgent healthcare-related needs; the adoption of remote, home-based offices for much of the workforce; and supply chain-related issues, depending on the material involved and the region of origin. To help us put the various concerns related to raw materials and chemicals in perspective, I asked key players in the industry for their viewpoints.

What is your key takeaway from 2020 and the impact of COVID-19 on raw materials and chemicals used for adhesives and sealants?

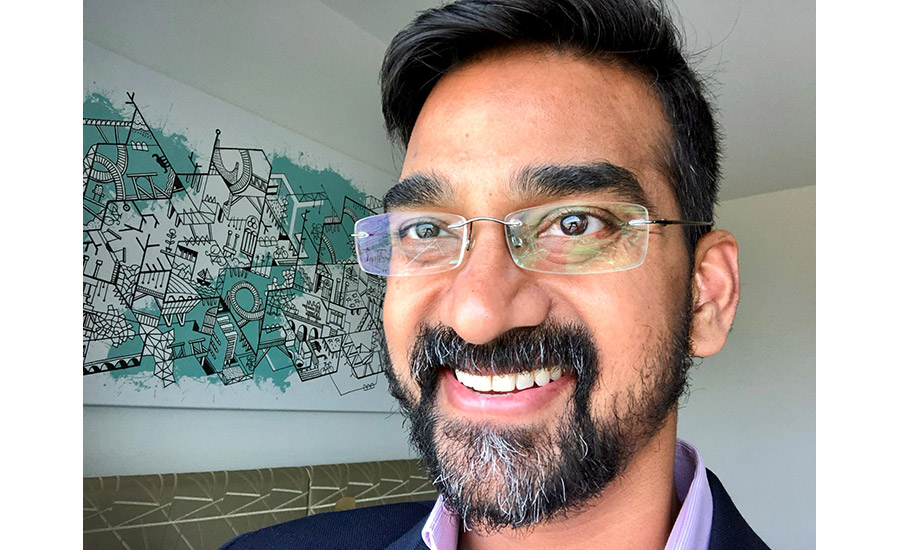

Mahendra Dorairaj, Vice President and General Manager-Adhesives, Eastman: We’ve found the chemical industry to be resilient and ingenious in its response to COVID-19. The crisis has highlighted its ability to be nimble and adapt operations, R&D, and supply chains to the dramatic change in economic conditions, industry dynamics, and consumption patterns. COVID has also accelerated IT and digital infrastructure build, so firms can stay competitive and agile in the remote work environment and ensure uninterrupted communication and collaboration with customers and value chain partners.

Data analytics, artificial intelligence, and customer relationship management through online tools are increasingly important and vital to the innovation process. It’s also critical to have a strong digital and social media strategy to understand the voice of the customer and respond in real time in a dynamic marketplace.

We’ve beefed up our capability to interact digitally and let our customers interact more dynamically with our offers. The Eastman Adhesives Portal is an excellent example. Customers can access digital interactive tools to evaluate how to formulate their adhesives with Eastman materials to get the best possible performance. It’s part of our commitment to a robust digital strategy.

Howard Hubert, Chief Commercial Officer, President-CASE & Plastics, Maroon Group LLC: Our collective experience as an industry has shown the critical importance of supply assurance and reliability to manufacturers of adhesives and sealants. Our customers who faced the challenge of meeting the market needs for critical applications (e.g., medical devices, PPE, food packaging, etc.) were able to do so through the commitment and focus of their manufacturing teams and their supplier/partners who were able to deliver on-the-fly solutions and rapid responses to a dynamic and unstable market. The experiences of 2020 have redefined what it means to be an “essential industry” and what is needed to be successful in this important industry.

Cassie Popovski, Marketing Manager Infrastructure, Covestro LLC: The resilience of the adhesives and sealants industry has been evident in the disruption of COVID-19. Manufacturing, research, and collaboration continued. Despite the challenges presented, the industry maintained focus on development and innovation for the future.

Ghislain de Quatrebarbes, Marketing Manager, Nynas: Nynas is one of the leading suppliers of hot-melt plasticizers for hygiene products (diapers), labels, and packaging and self-adhesive tapes. We operate worldwide, although the majority of our sales are in Europe. What we have learned is the important role of adhesives in ensuring the supply of consumer goods in times of lockdown. Especially in the area of packaging, it was crucial to be able to continue to deliver to our customers.

Mike Rezai, Senior Consultant, The ChemQuest Group: Offshore suppliers tend to require long and complex supply chains in supporting U.S.-based OEMs, including the sourcing of adhesive and sealant materials. Consequently, a short-term effect was inevitable due to COVID-19 temporary lockdowns and unpredictable inventory turnover that was exacerbated by fluctuating demand. Shipping during the pandemic presented challenges and increased costs across the supply chain due to a persistent shortage of truck drivers. Simply put, the geographic location of the supplier is a key consideration, with China and India being the most challenging. An additional issue related to China is that the country is taking a predatory approach. Many are seeing 12-15% export tax rebates (the highest for some time) for exported products like pigments and resins as China attempts to regain lost share due to both tariff restrictions and COVID-19.

Separately, the evaluation and creation of new materials has stalled due to social distancing measures, producing a status quo of technologies and products. Understaffed labs that are tasked with developing new products are critically falling behind with respect to formulating, validating, and ultimately commercializing innovative product portfolios. Consequently, we foresee a 10-12-month lag compared to previous periods for the introduction of new materials and innovations.

How did the pandemic impact the industry’s supply chain?

Dorairaj: COVID clearly disrupted supply chains, especially where there’s a long chain. As a result, we expect to see stronger regional/local supply chains vs. interregional supply. We also anticipate security of supply becoming a key factor in raw material supplier selection going forward. The additional costs and uncertainty of taking material from point A to point B will become an increasingly important part of the business equation.

Generally, we’ve seen tighter inventory control and lead time adjustments across the industry. Demand reduction in durables was somewhat compensated for by increased demand in consumables. Businesses have adjusted manufacturing operations to support increased demand in a COVID-constrained environment while tightly managing cash flows.

Agile supply chains that can adapt quickly to rapid demand changes are the most successful in the current environment. Making sure everyone stays supplied and minimizing disruptions in the value chain have been the highest priorities. Firms have taken advantage of what they learned from COVID and have optimized their supply chains and operations to be more robust.

Hubert: Very much a “tale of two cities”—critical products saw exponential demand over a very short timeframe, and other products saw significant loss of demand based on the end market response to the pandemic. As we know from more than 40 years servicing the adhesives and sealants markets, security of supply is, and always will be, an essential attribute of the value-chain. This dictates that the ability to meet changing market demands—at times dramatic—reaffirm the importance of assurance and reliability of supply. As raw material manufacturers meet the challenges within complex supply chains, COVID reduced workforces, and onsite personnel restrictions, there is more of an emphasis on distribution to accept a larger portion of the responsibility for keeping the supply chain intact and viable.

Popovski: Construction was largely deemed essential in the early stages of COVID-19 shutdowns. Even though work was allowed to continue, however, modified protocols and access to client sites caused disruptions to productivity. Schedules were even further extended because in northern regions, climate is a limiting factor of construction output. Work lost in the summertime cannot simply be pushed to year end. Disruptions such as these impact the demand for adhesives and sealants, and we anticipate that residual effects of COVID-19 will last into 2021. However, despite the challenges presented by the pandemic, we have seen recovery in the construction space in 2020 and are prepared for what the next year will bring.

de Quatrebarbes: In the second quarter of 2020, we had to face a demand for hot-melt plasticizer that was almost twice as high as the traditional demand. Thanks to the company’s fast reaction, we were able to ensure continuity of supply. This required a formidable capacity to adapt, particularly for our production. I must say that I have found the same willingness among our adhesive manufacturers to meet this higher demand.

Rezai: In general, all components of the industry supply chain were deemed essential. Thus, any delays and disruptions were chiefly attributed to labor restraints and workforce limitations, as well as trade restrictions and declining overall consumption. However, the adhesive and sealants supply chain did promptly respond to the challenges with optimization measures designed to reverse the anomalies caused by COVID-19 to mitigate further delays and disruptions.

Have you seen changing demand from adhesives and sealants manufacturers that target specific end-use sectors/industries?

Hubert: There has been a definite shift in the demand of products for industrial use to those designated for the consumer markets. We’ve experienced sustained increase in demand for materials going into end-use packaging for prepared foods, general packaging, medical and PPE, as well as increases in items that feed into durable goods. As a result, we’re doing a lot of work supporting the growing needs in these areas, working with our principal suppliers and applications labs on new formulations in collaboration with our customers while always seeing quite a bit of interest in innovation. As you would expect, we experienced an exponential increase in demand for ingredients and packaging solutions for sanitization, cleaners, and disinfection, which we were able to successfully meet.

Popovski: Extended time in the home environment, coupled with more free time, catalyzed a surge in around-the-house projects. The do-it-yourself (DIY) spike has had far-reaching effects in the adhesives and sealants industry, especially in the building and construction space.

de Quatrebarbes: The coronavirus crisis has already led to some of the sharpest declines in recent times in demand for certain types of adhesive, mostly in the automotive and industrial areas, but we see some signs of recovery. We have seen also accelerating growth for others, such as tapes used in packaging for e-commerce shipments, which are emerging as lifelines in this new world.

Rezai: Adhesive and sealant end markets are experiencing varying levels of demand. Packaging, hygiene, and consumer/DIY are performing better than other sectors. Specifically, the DIY sector is benefiting from stay-at-home orders—home improvement projects are escalating and thus DIY products have benefitted.

Packaging is also experiencing strong demand, with significant increases in everything from single-serve to microwavable foods, as well as food and beverage packages and containers, flexible packaging, pet food packaging, and any end-of-line case and carton packaging. This trend is expected to continue due to consumer behavior and the resulting rise in e-commerce and online orders (ecommerce increased by around 37% in the third quarter of 2020, compared to the same quarter in 2019).

How has COVID-19 impacted sustainability efforts in the industry and with your company?

Dorairaj: R&D organizations have evolved and adapted to remote environments to ensure long-term innovation isn’t completely overwhelmed by short-term operational challenges. Coming out of COVID, firms that continued to invest in innovation despite the crisis will outperform those that didn’t. We’ve doubled down on our innovation programs with specific focus on consumer safety, high performance, and sustainability in adhesives. Ultimately, the design of raw materials is driven by sustainability of end products (e.g., diapers, cars, end-use packaging). This has driven changes in the design and composition of finished goods.

Adhesive materials must adapt and still perform without adversely affecting the sustainability of the finished good. The adhesive can’t be the weak link. It must be durable enough to sustain in-use exposure while enabling recycling processes after life. Likewise, polyolefin adhesives that enable the use of recyclable olefin substrates can make the whole solution recyclable. We’re energized by these challenges, which are driving some of the top innovations in our growth platforms. Examples include our continued investment in developing and launching low-odor, low-VOC, low-SOI, and improved color tackifiers, as well as high-performance thermoplastic polyolefin polymers for hot-melt adhesives.

At a corporate level, we’ve committed to innovating for a sustainable future, mitigating climate change and mainstreaming circularity as outlined through our sustainability report, “A Better Circle.” To help mainstream circularity, we plan to: recycle more than 500 million lbs of plastic waste annually by 2030 via molecular recycling technologies, with a commitment to recycle 250 million lbs annually by 2025. And we plan to catalyze improvement of the recycling system by continuing to expand capabilities to recycle more complex products and by participating in initiatives and collaborations to drive increased collection.

Hubert: Maroon issued our first Sustainability Report in 2020. While the timing was unusual (due to the pandemic), our commitment to sustainability initiatives was born years before COVID-19. We saw this commitment as an essential aspect of being a responsible steward of the industry, an employer of choice, and an organization of the future. The detrimental challenges of COVID-19 only reinforced our resolve to our sustainability efforts as these implemented initiatives helped our company succeed through the pandemic, ensuring our sustained success. Maroon has been Ecovadis certified for years, and our Sustainability Report was the continued commitment to this initiative. We see this level of engagement as being important to our customers and our principal suppliers because they tell us so.

Popovski: Sustainability has been a long-standing core value to Covestro. Our goal is to completely align production and product range, as well as all areas in the long term to the circular concept.

de Quatrebarbes: Covid-19 has had a strong psychological impact. I noted that demand for adhesives that are more respectful of the health of consumers but also of the environment is still as strong as ever.

Rezai: Sustainability is still a focus but sustaining the enterprise and livelihoods moved to the forefront temporarily. As mentioned, new material investigation has stalled due to understaffed laboratories. Our technical arm, CQTI, had an increase in sustainability related projects, some of them triggered by lab shutdowns.

What is your company’s outlook for the future?

Dorairaj: In the next year, we will continue our commitment to long-term innovations, learning from COVID and adjusting business models to be nimble in the post-COVID world. A&S could drive sustainability by enabling chemical and mechanical recycling. Brands have made bold sustainability commitments that are driving the whole value chain to follow. Design for circularity will mean more integrated value chain innovation. Raw material suppliers, adhesive formulators, film manufacturers, food packaging converters, and brands will increasingly work together to develop sustainable solutions. We anticipate and are excited about more joint value chain collaboration and innovation. To respond to trends and drivers in end-use markets, A&S must minimize SOIs, VOCs, chemicals of concerns, and hazardous materials. We foresee increased regulation for consumer safety driven by consumer awareness, nongovernmental organizations, and influencers, leading to material innovations.

In the long term, we expect innovation driven not only by regulation but also by code of conduct, sustainability, circularity, and renewable material commitments from brands that necessitate cleaner and sustainable adhesives.

Hubert: We’re incredibly optimistic and enthusiastic about the future—both short- and mid-term. The challenges of COVID-19 allowed our company and employees to grow in the face of very real risk and uncertainty, reinforced our culture, and stretched our teams to deliver for our customers and principals. We’ve adapted well and learned a lot from COVID, as our experience has encouraged our company to implement process and operational changes we’ve evaluated over the years with very positive results in every aspect of our business model. We’ve embraced new ways to assess risk and develop mitigation strategies, as well as learning to conduct business in a virtual environment, acknowledging that you don’t have to fly across the country (or the ocean) to collaborate with a partner. Building on our sustainability initiatives, our business is stronger than ever, more efficient and focused on our goals, independent of the extent of the effect (or duration) of the pandemic. We’re prepared for the future and a clear focus on our business plan with the confidence we flourished through the worst health care crisis in more than 100 years.

Popovski: Despite the challenges presented this year, Covestro is excited for the future. In order to maintain collaborations internally and externally, Covestro had to adjust its methods of operations and communication. Digitalization was rapidly accelerated to enable meaningful interactions across the value chain. The lessons learned will have far-reaching effects as we incorporate these new habits into post-pandemic life. We’re hopeful that our increased digitalization will lead to more frequent and meaningful partnerships with our customers as we solve the unmet needs of the industry.

de Quatrebarbes: In the short/medium term, Nynas continues to work with its adhesive customers firstly to adjust production capacity and thus continue to ensure a response to the increasing demand for the hygiene, tape, and packaging markets. Nynas is also mobilizing its technical and industrial capacity to continue to innovate. We are preparing a new, even purer plasticizer to meet the ever-increasing consumer demand for eco-friendly products.

Rezai: We expect adhesives to recover nicely due to an improving macro backdrop (assuming the COVID-19 vaccine rollout becomes widespread) and pick-up in industrial output to meet pent-up demand, as vaccinated workers resume more typical face-to-face activity levels in the workplace (albeit with added health and safety precautions). With respect to major end markets for adhesives, robust growth is expected in 2021, including: autos, with OEM builds expected to be up 14%; U.S. housing to see new builds up 5% and existing home sales up nearly 10%; electronics/semiconductors to enjoy volume growth of mid-teens in 2021; and lastly, even aerospace is likely to start improving off the bottom in late 2021.

That said, long-term economic growth may be curtailed below the historical average due to the impact of increased indebtedness globally on GDP growth and tougher Made in America rules mandated by executive order in January 2020. In short, current market dynamics are pulling demand forward to the near-term, very likely at the expense of future growth prospects, unless G20 leaders enact comprehensive debt restructuring and reinforce a global financial safety net to mitigate pandemic-induced debt, as outlined in the G-20 Leaders’ Summit, Virtual Meeting minutes.1

For more information, visit these companies online at https://chemquest.com, www.covestro.com, www.eastman.com, www.maroongroupllc.com, and www.nynas.com.

Reference

- “Group of Twenty G-20 Surveillance Note,” International Monetary Fund, G-20 Leaders’ Summit, Virtual Meeting, November 21-22, 2020, www.imf.org/external/np/g20/pdf/2020/111920.pdf.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!