Strategic Product Development: A Framework Towards Building an Innovation Pipeline Aligned with Market Growth

How to build and manage a strategic product development pipeline that aligns internal capabilities with targeted market opportunities.

Summary:

Many companies tend to adopt either a product-push strategy — where R&D develops new offerings without clear market direction — or a reactive custom-solution approach, where teams scramble to meet individual customer demands. Both methods can place considerable strain on R&D resources and the sales force, often leading to inefficiencies and distractions. A more sustainable approach is a hybrid, data-driven model grounded in the performance of existing products with current customers. This method enables organizations to leverage real-world insights and systematically evolve their offerings. The product-market matrix serves as a strategic framework to guide this evolution — supporting efforts to enhance existing products, penetrate new markets, and eventually diversify. This article explores how to build and manage a strategic product development pipeline that aligns internal capabilities with targeted market opportunities, ensuring long-term growth and innovation.

Problem with Traditional Models

There is considerable confusion in the B2B industry around how to effectively develop new products for well-defined markets. One common approach starts in R&D, where ideas are generated internally — often based on conceptual thinking or limited input — and handed off to the sales team to find a market fit. In the adhesives world, this method is summed up by the saying: “If it sticks, it sells.” While there’s some truth to that — most products eventually find some use — it places an enormous burden on sales to identify the right application, often resulting in endless travel, cold calls, and speculative pitches. The phrase “25 to 30 pitches lead to one sale” highlights just how inefficient and draining this can be. It also leaves R&D unclear on which product attributes truly drive customer value, and manufacturing teams struggling to maintain quality without a clearly defined end-use.

In response, some companies swung to the opposite extreme: securing a customer first and then urgently tasking R&D and manufacturing with developing a custom solution. These so-called “alpha” or “beta” customers drive product development based on immediate needs, not long-term strategy. While this customer-led approach appears more targeted, it comes with its own inefficiencies. R&D is often unable to meet tight timelines, quality issues can arise over time, and there’s no assurance that these initial customers will scale — or that others like them exist. The company may end up perceived as a custom solutions provider, forced to demand premium pricing that many customers resist. Manufacturing, in turn, faces mounting complexity in producing a growing number of low-volume, niche products while trying to maintain consistency.

This back-and-forth has left many organizations — particularly in the latex, adhesives, and CASE industries — unsure of the right direction. Should innovation be pushed from R&D outward, or pulled in response to customer demands? Having worked across multiple companies in this sector, I can say that few have built a clearly defined, repeatable system for driving innovation efficiently, without straining teams or resources.

The bigger question is: How can we build a system that delivers consistent, scalable, and assured new product development process — one that not only drives long-term growth but also keeps the innovation pipeline reliably filled?

There is no one-size-fits-all solution. Success starts with leadership that has a clear, realistic view of the organization’s capabilities and constraints. From there, the company can design a product development model tailored to its strengths — one that aligns its resources, market goals, and operational structure into a cohesive, sustainable strategy.

Strategic Product Development: A Hybrid Approach

Effective product development is rarely a black-and-white process. It is neither solely market-driven — where action is taken only after exhaustive external analysis — nor entirely R&D-led, where products are developed in isolation and then pushed into the market. Both approaches carry the risk of misalignment, inefficiency, and wasted resources.

A more successful path lies in a structured hybrid model that integrates internal capabilities with real market needs. This approach begins with a strong understanding of existing products and customers, then evolves through ongoing feedback, validation, and iteration. By aligning R&D efforts with clear market direction, this model ensures that development is purposeful and value-driven, while enabling sales teams to stay focused and effective.

Why This Approach Works

1. Real-Time, Reliable Feedback from Trusted Customers

The core strength of this approach lies in its access to high-quality, real-time feedback from your most trusted customers — those who already value your brand and consistently purchase your products. These relationships, built over time by your sales team, are an invaluable asset. Because of this trust, the insights your sales team gathers are not only frequent but also highly credible. In product development, the quality of input determines the quality of output. When market intelligence is accurate and relevant, new products are far more likely to align with actual customer needs.

This enables a customer-integrated innovation process:

- You can begin developing next-generation versions of proven products tailored specifically for your B2B customers.

- Trusted customers are more likely to participate in early-stage testing because they understand the mutual benefit — you’re enhancing a product to better serve their evolving needs.

- Their feedback tends to be honest, actionable, and constructive, enabling faster iteration cycles and stronger final outcomes.

This method doesn’t just improve current offerings; it creates a competitive edge. Enhanced products that are validated by existing customers can expand market share, attract new buyers, and reinforce loyalty.

In essence, you’re not reinventing the wheel — you’re building on proven success. Your strongest relationships guide your innovation strategy, reducing risk, increasing market relevance, and improving your chances of outperforming the competition.

2. Leveraging Historical Data and a Proven Foundation

Another reason this approach succeeds is that you already have a rich base of historical data on both products and customers. By systematically analyzing this data, you can:

- Spot usage patterns

- Anticipate future needs

- Predict timelines for product upgrades with higher confidence

These insights enhance forecasting and strategic planning. They help validate assumptions, reduce development risk, and ensure that new product iterations are timely, relevant, and aligned with market demand.

While this customer-centric stream may be just one part of your broader innovation pipeline, it’s arguably the most reliable. Products rooted in proven performance and built around trusted relationships carry lower risk and a higher probability of commercial success.

This strategy enables you to scale from a strong foundation rather than starting from scratch. It supports faster time-to-market, more confident launches, and value delivery to both existing and new customers — with minimized uncertainty.

Challenges It Addresses: Scaling Within the Known vs. Venturing into the New

This hybrid model is most effective when expanding within an existing market by launching refined or advanced versions of current products. It's a strategy of deepening market penetration — same market, same core product — executed through structured, deliberate growth.

This approach also addresses the complexity that arises when:

- Launching entirely new products within the same market: Here, you must carefully manage risks of cannibalizing your legacy offerings, while navigating competitive responses that may leverage alternative chemistries or technologies.

- Entering new markets with new products: This is the most challenging path, requiring a deep understanding of unfamiliar customer needs, distribution channels, regulatory environments, and competitive landscapes — all while crafting a compelling and differentiated value proposition.

Strategic Product Development Framework

This framework presents a structured, step-by-step approach to drive product development strategically within an established market environment. It helps align internal strengths with external opportunities, reducing guesswork and increasing innovation success.

Step 1: Internal Analysis – Define Your Strategic Relevance

Begin by assessing your current position in the market. Ask yourself: What is our core value today? This can be evaluated from two complementary perspectives:

A. Customer-Based View

- Rank customers by purchase volume.

- Focus on your top five customers or those representing ~80% of total sales.

- Ask:

- What are they buying?

- What trends or shifts are occurring in their industries?

- What future needs or strategic directions are they signaling?

- These key accounts are the foundation of your business. Retaining and growing them must be a strategic priority.

B. Product-Based View

- Rank products by sales volume or profitability.

- Focus on the top-performing products:

- What makes them successful — performance, cost, brand equity, or service model?

- Are they differentiated or easily commoditized?

- Understand the value drivers that resonate most with your customers.

Step 2: Correlation – Who Buys What, and Why?

Now, link your customers and products. Identify where the most value is being created.

- Are your best customers buying your best products?

- If not, why is there a disconnect?

- If yes, what are the margin contributions and sales volumes at these intersections?

This step helps pinpoint the combinations of products and customers that create the most strategic value — through both revenue and relationship strength.

Step 3: Market Direction – Where Are Your Customers Headed?

Shift your focus outward. Analyze the evolving priorities of your top customers.

- Are they focusing on sustainability, automation, cost reduction, process or performance improvement?

- What pain points or growth opportunities are emerging in their industries?

These insights should directly shape your product development roadmap. You’re no longer innovating in isolation — you’re aligning new offerings with clear, forward-looking customer needs.

Step 4: Synthesis – Feed Insights into the Development Pipeline

Once you’ve triangulated:

- Internal product performance,

- Strategic customer relationships,

Emerging market needs,You now have a solid foundation for defining the features, performance benchmarks, and value propositions of your next-generation products.

This structured, insight-driven approach transforms product development from speculative R&D to a strategic growth engine rooted in customer value and market reality.

Step 5: Align with the Product-Market Matrix

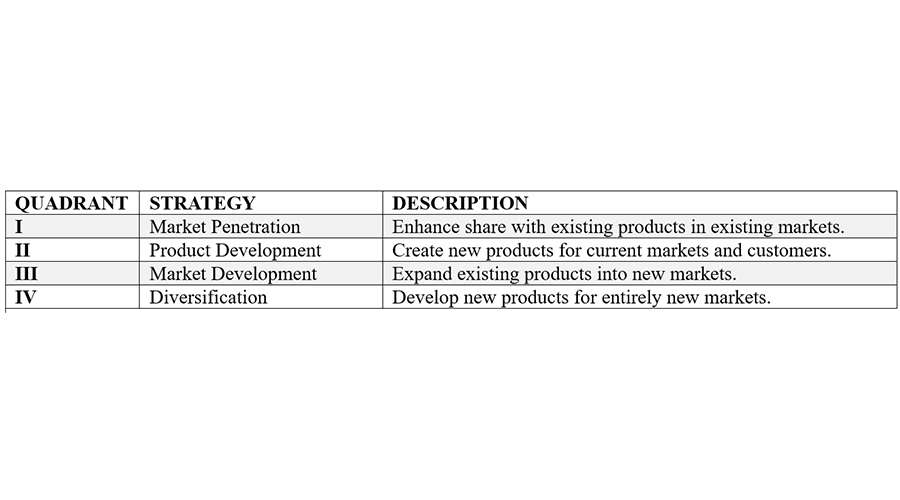

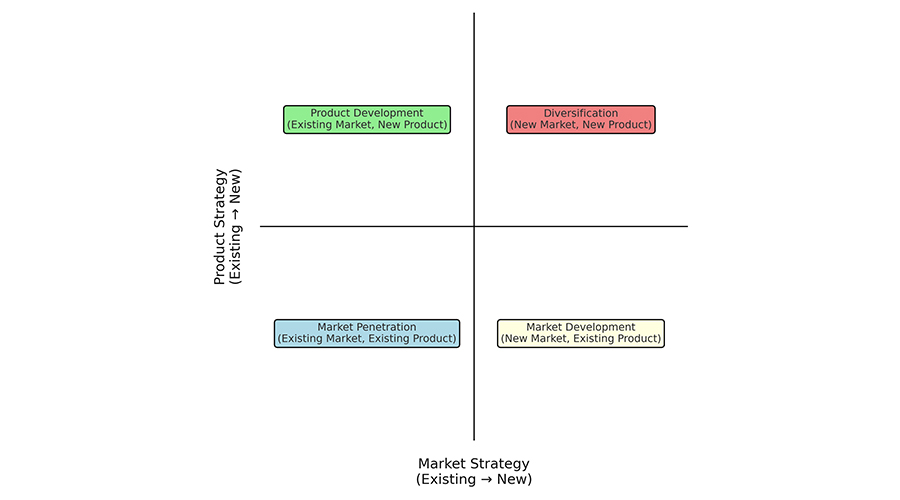

At this point, your insights can be mapped to the classic Product-Market Matrix to guide strategic innovation across four core areas:

This matrix helps organizations prioritize development opportunities, avoid random pursuits, and ensure alignment between internal capabilities and external growth paths.

Product-Market Expansion Matrix

Deepening Customer Penetration (Quadrants I & II)

Building a strong new product pipeline requires a strategic, deliberate, and forward-looking approach. A logical and low-risk starting point is the development of improved or next-generation versions of existing products for your current markets. This is best done in close collaboration with existing customers, who can act as early validators and provide real-time feedback as you refine performance attributes or processing characteristics.

Once validated, these upgraded products can be promoted more broadly across the existing market, targeting new customers who are already familiar with the category. With clear, quantifiable value propositions — such as improved performance, greater processing efficiency, sustainability benefits, or cost savings — your sales team is better positioned to differentiate and win.

At the same time, it is critical to continuously monitor the competitive landscape, particularly in core product categories. On a quarterly basis, ask:

- Are competitors launching improved or next-gen versions?

- Are new chemistries or disruptive technologies entering the space?

- Are there emerging threats that could challenge the positioning of your enhanced products?

Given the significant investment involved in product development, defending your market position is just as important as innovating. Stay proactive. Incremental improvements, delivered consistently, will compound into meaningfully differentiated offerings that reflect evolving customer needs while reinforcing your market leadership.

This is the essence of effective execution within Quadrants I and II — new or enhanced products in existing markets — where your R&D and commercial capabilities are aligned, and your risks are lower due to a well-understood customer base.

Exploring New Markets (Quadrant III)

Once your core is solid, the next strategic opportunity is market development — introducing existing or slightly modified products into new customer segments or geographies.

New markets can take several forms:

- Geographic expansion: Untapped regions within your country or abroad.

- Adjacent applications: Related industries or uses not previously targeted.

For example, a pressure-sensitive adhesive (PSA) latex currently used in tapes may find new applications in graphic films, flooring adhesives, cementitious compounds, wood adhesive laminations, or sealants.

These opportunities do not emerge by accident. They require strategic exploration and disciplined follow through. Successful market development demands a dedicated team — often embedded within R&D but working closely with commercial functions — that is tasked with identifying and validating new use cases.

This team must combine technical creativity with commercial intuition, enabling them to visualize adjacent opportunities, build prototypes, test performance in unfamiliar applications, and create compelling value propositions.

Breakthroughs in new markets are rarely the result of luck. They are the outcome of systematic, cross-functional exploration backed by leadership commitment, proper resources, and iterative learning.

While market development projects are more demanding than customer penetration strategies, they still leverage known technologies and existing competencies — making them a strategic second priority in your development pipeline.

These initiatives require balanced effort across R&D, sales, and marketing. A critical mistake organizations often make is siloing these functions, leading to fragmented execution and poor outcomes. For market development to succeed, cross-functional collaboration must be rooted in shared accountability, mutual respect, and continuous information exchange.

The Path to Diversification (Quadrant IV)

Finally, the most complex quadrant of the Product–Market Matrix: new products for new markets — commonly referred to as diversification.

This strategy involves the highest degree of uncertainty, resource requirements, and organizational coordination. It should not be rushed. If your company lacks surplus capacity, stable revenue streams, or a mature innovation process, diversification can easily become a costly distraction.

However, diversification is often not a deliberate leap — it is an evolutionary outcome. By consistently operating in Quadrants II (product development) and III (market development), companies gradually build the competencies, customer insights, and infrastructure needed to succeed in new markets with new offerings.

Examples from the corporate world reinforce this approach:

- Apple evolved from computers to phones, digital services, iPads and wearables.

- Honda transitioned from motorcycles to automobiles, generators, and even jet engines.

- Samsung moved from trading to electronics and home appliances.

- 3M evolved from a mining to sandpaper, tapes, adhesives, consumer items and many more by embracing innovation and diversification, strategically.

None of these companies diversified overnight. Their growth was the product of structured, adjacent innovation over time.

Smart organizations understand this: diversification should be the result of sustained success in known spaces — not the starting point. As your organization grows in capability and confidence, you can step into new spaces from a position of strength, not speculation.

When this happens, you're not venturing into the unknown — you’re leveraging:

- Years of accumulated product knowledge

- Strong customer relationships

- Mature infrastructure

- A culture of innovation and collaboration

This form of organic diversification reduces risk because it is built on momentum, not guesswork.

In contrast, organizations that attempt diversification without first securing success in Quadrants I–III often struggle with fragmented focus, misaligned priorities, and disappointing returns. That’s why leading companies treat diversification as the final milestone in a deliberate innovation journey, not the opening move.

Conclusion:

Sustainable growth doesn’t come from bold bets — it comes from disciplined progression. The most resilient and high-impact innovation strategies begin by strengthening your core through Quadrants I & II (Product Development) and III (Market Development). From this solid foundation, diversification (Quadrant IV) should emerge as a natural evolution — not as a premature or high-risk leap.

Strategic product development is not about sporadic invention or chasing trends. It’s about building a repeatable, insight-driven innovation engine. This requires aligning R&D with real customer needs, involving sales and marketing early in the process, and maintaining a sharp focus on competitive dynamics.

When executed well, this approach ensures that your product pipeline is:

- Aligned with market demand

- Grounded in organizational strengths

- Capable of delivering both short-term wins and long-term growth

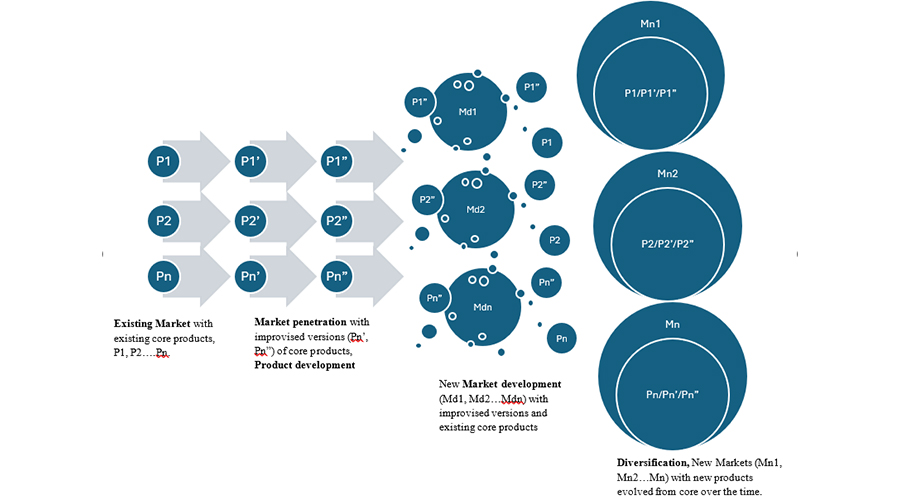

Strategic Product Development Pipeline

The following S-curve and product pipeline evolution diagram represents a unified progression through the Product–Market Expansion Matrix. It illustrates how companies can evolve from core market focus (Quadrants I and II) to adjacent growth opportunities (Quadrant III), and eventually toward sustainable diversification (Quadrant IV).

- Initial Focus: Market penetration & product improvements

- Mid-Term Strategy: Market expansion into adjacent segments

- Long-Term Evolution: New products for new markets

This structured, step-by-step journey helps transform innovation from a chaotic process into a strategic lever for market leadership.

For additional information about Trinseo, visit www.trinseo.com.

Images within the article are provided courtesy of Trinseo.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!