Rising Platinum Costs Impact Pressure-Sensitive Industry

Unfortunately, the cost of platinum metal, like any commodity, can fluctuate widely on the global commodity exchange. Recently, platinum has spiraled upward at an alarming rate and is not forecasted to decline in the near future. In 1999, the metal traded for about US$360 per troy ounce (approximately 31.10 grams). By May 2006, the price had more than tripled as it reached a historical record US$1,340, rising over 50% in the last year alone.

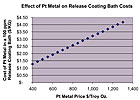

This trend has very real consequences for the pressure-sensitive industry. For example, at US$850 per troy ounce, every 100 ppm (0.1 gram) of platinum metal in a release coating costs US$2.73. At current levels of US$1,320, that portion of the release coating manufacturing cost reached US$4.24. This calculation reflects raw metal costs only; it does not include inventory, packaging, transportation and processing (see Figure 3).

A Case of Supply and Demand

Why is this happening? It is a simple case of supply-and-demand economics? According to Platinum 2006, a report published by London-based platinum commodity market experts Johnson Matthey, demand for platinum grew by 2% to 6.7 million ounces in 2005, an annual rise of 160,000 ounces. Purchases by the autocatalyst sector again grew strongly, and use of the metal in the glass industry and electrical applications also increased.Demand for platinum in autocatalysts increased by 9% in 2005 to 3.82 million ounces, a record high. Much of the growth was generated in Europe, where diesels continued to increase their share of passenger vehicle sales. At the same time, the advent of Euro IV emission limits plus the introduction of catalyzed soot filters led to an overall rise in platinum loadings.

Demand for platinum in industrial applications reached 1.675 million ounces, driven by the construction of new LCD glass furnaces in Asia and greater consumption of the metal in hard disks. Sales of platinum to the glass industry and for personal computer hard disks both rose by over 20% in 2005.

Supplies of platinum expanded by 140,000 ounces to 6.63 million ounces in 2005, with greater output from South Africa, Russia and Zimbabwe.

South African production increased by 2% to 5.11 million ounces, less than anticipated as smelter and mine accidents hampered efforts to expand output, as did a slowdown caused by transitioning from mechanized to conventional operations at a key site.

Russian sales of platinum increased by 5% to 890,000 ounces in 2005, with relatively stable production from the alluvial mines in the Far East of Russia.

In 2005, supplies of platinum from Zimbabwe grew by 7% to reach 156,000 ounces. Further modest upgrades to capacity are being undertaken, but the fate of more substantial investment is once again in the balance, following government proposals of March 2006 that could result in the government of Zimbabwe taking a substantial stake in foreign-owned mining operations.

Even though overall global supplies of platinum grew in 2005, they expanded at a similar rate to demand. Thus, the platinum market remained undersupplied by 70,000 ounces, the seventh successive year of deficit.

This creates a serious situation for the release-coating industry. Pressure-sensitive products consume less than 1% of the world's platinum output, but with no potential today to recycle the metal, the industry remains at the mercy of the market. However, the need for platinum continues to grow. In fact, platinum consumption for applications in the pressure-sensitive industry has historically grown as fast or faster than platinum demand in total. According to Platinum 2006, "Consumption of platinum in the chemicals sector grew by 3% to 335,000 ounces in 2005. Demand for platinum-based catalysts for the production of silicones increased, thanks to the addition of new manufacturing capacity in Asia. ... Supplies of platinum and demand for the metal are both forecast to grow more strongly in 2006 than last year. Consequently, we expect the market to remain in moderate deficit."

What's more, prices could become substantially more volatile should speculation increase. Price elasticity of demand is relatively low for most platinum applications. Even where substitutes like palladium or rhodium are available, they, too, are afflicted by the same basic imbalance. This means restrictions in supply can drive the price up sharply.

In short, supply and demand have put silicone suppliers in a very difficult situation as they strive to maintain price stability for their customers and for the pressure-sensitive industry. And it is unlikely that the situation will soon resolve itself.

In Search of Solutions

Despite significant research investment, the silicone industry has yet to find an alternative to the platinum catalyst that can match its technical performance. For most industrial applications where platinum is being used for its catalytic ability, the few remaining substitutes are either similarly expensive or in very limited supply.Alternatively, one might consider UV-curable release coatings as a potential solution as UV technology is not dependent on platinum. However, UV coatings are inherently very expensive (approximately two times more expensive than thermally curable platinum systems). This is mainly due to expensive photoinitiators and batch processing. In addition to its high cost, UV technology exhibits severe technical limitations that have constrained its massive use in release coatings beyond some specialty applications.

Consequently, a switch away from platinum metal catalysts seems unlikely for most pressure-sensitive release coating applications.

In the face of this seemingly irreconcilable problem, silicone suppliers around the world are fighting tight margins in every area of the value chain and struggling to maintain price stability for their customers. However, everyday it becomes more evident that the silicone industry cannot continue to absorb this huge raw material cost increase without jeopardizing its ability to bring quality products to market.

One way to meet this challenge is to create innovative technologies that reduce dependence on platinum. "At Dow Corning, we are using our technology to ensure price stability by reducing cost and exposure to platinum metal cost increases," says Shelley J. Bausch, Global Industry director for Dow Corning Pressure Sensitive Industry.

Instead of waiting for capricious commodity prices to fall, Dow Corning Corp. adopted a proactive stance early on, took a risk and invested heavily in the development of its Syl-Off® Advantage Series Solventless Silicone Release Coatings. The low-cost series is designed to help reduce vulnerability to swings in platinum metal prices without sacrificing performance.

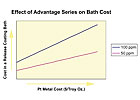

The system enables significantly lower platinum usage (20-50 ppm vs. 100 ppm or more required by conventional systems), making 10-15% reductions in silicone costs possible in many high-volume applications. Dow Corning brought the Advantage Series to market in 2004 with extensive technical support designed to allow early, successful implementation of the new coating line. The company continues to offer both high- and low-platinum coating system options.

In addition, Dow Corning provides services and solutions that help their customers manufacture robust products at the lowest possible cost through process optimization, such as oven and coating line setup, ensuring optimal coat weights and substrate optimization.

Commodity Price Index

Adopting an index-based pricing structure is another way to share the financial risks of severe fluctuations in commodity costs. This practice typically establishes a base product price and then separates out the commodity portion as a discrete line-item. Index-based pricing is common to many industries that are sensitive to commodity costs. Indeed, all industries involved with precious metal use this pricing mechanism.Index-based pricing for commodities allows for transactional transparency that benefits both the supplier and the customer: suppliers and customers share the risk of the commodity price levels while customers clearly see that they are paying only pass-through costs, which can increase or decline.

"Dow Corning has always been committed to doing whatever it takes to help our customers succeed," Bausch says. "We saw the effect that platinum pricing was having in the industry and moved quickly to provide the Advantage Series line. I'm confident that, with continued support and partnership, we will find new and innovative solutions to bring our customers the products and service they need to succeed in this challenging and volatile market."

For more information on the Advantage Series and other Dow Corning products, visit http://www.dowcorning.com/psi . For more information about the platinum commodities market, visit http://www.platinum.matthey.com .

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!