Radiation Curing: A Specialized Adhesive Technology

Radiation curing has carved out a niche in several important adhesive applications.

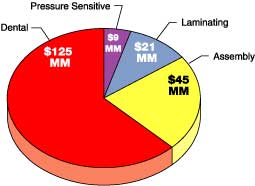

Total: $200 MM

U.S. consumption of radiation-cured adhesives was 8 million pounds worth $200 million in 2000. Radiation-cured technology represents 3% of U.S. adhesive industry sales but less than 1% of the volume. The industry is forecast to expand at a modest 3% yearly rate while rad-cure technology is advancing at a robust 12% annual rate. Radiation-cured adhesives are largely purchased by small users for specialized bonding applications.

End Use Review

The figure summarizes the consumption of radiation-cured adhesives in the United States by end use. The largest dollar-value end use for radiation-cured adhesives is dental.Some $125 million of radiation-cured adhesives are used in dental procedures that include composite restoratives, bonding agents, luting cements, sealants, etc. Prices are extremely high on a poundage basis because of small packaging, use of expensive and high-purity materials, distribution costs, and the added cost of other components such as syringes and mixing wells. Radiation-cured dental adhesives began replacing amalgam fillings in the early 1970s. The growth of cosmetic dentistry created new applications and fueled demand. Ultraviolet (UV) light was originally used, but it has given way to visible-light (VL)-curing products.

The second-largest end use for radiation-cured adhesives is the broad assembly-adhesive category. Included here are medical, automotive, electronic and optical applications. Several novel radiation-cured chemistries are used.

Many assembly-adhesive applications involve the bonding of plastics or dissimilar materials, and radiation-cured technology is well suited for bonding these materials. In some cases, the radiation-cured formulation is additionally cured with catalyst, heat or moisture. Some products are dual-cured with both UV and visible light.

Radiation-cured assembly adhesives are expensive because of specialized property requirements and low-volume purchases. An example of specialized requirements is medical applications that are tested for biocompatibility under ISO Standard 10993.

Laminating accounted for 10% of the radiation-cured adhesive value. Laminating applications include DVD bonding, film-to-paper and film-to-film laminating for labels and other flexible-packaging applications, and paper to composite-board laminates for furniture.

DVD lamination is a recent application for radiation-cured technology. Volume is surging for DVD bonding because of the explosive growth of DVD technology in video and computer applications.

In flexible-packaging laminates, radiation-cured technology is currently a minor percentage of the adhesive volume; solvent-based adhesives are still widely used. Radiation curing offers the elimination of solvents and fast cure.

Pressure-sensitive products took 5% of the radiation-cured adhesive volume. Most are used for high-performance tapes, but a small amount are used for labels. Crosslinking by radiation improves high-temperature resistance as well as solvent and other chemical resistance compared to traditional thermoplastic pressure sensitive adhesives. Rad-cure technology is more environmentally friendly compared to high-performance solvent-based adhesives and eliminates the need for drying ovens.

Rad-Cure Technologies

Visible-light-cured formulations comprise a minute portion of the radiation-cured adhesive poundage but over 60% of the dollars. VL-cured products are used in the dental marketplace. UV-cured technology is 70% of the rad-cure pounds and just over one-third of the dollars. Some of the UV-cured formulations are dual-cured by also irradiating with VL. Electron beam (EB) technology is one-quarter of the weight and 2% of the dollars. The manufacturers of furniture laminates and high-performance pressure-sensitive tapes produce EB-cured adhesives in-house.

Numerous polymer technologies are used to produce radiation-cured adhesives. Most are based upon free-radical-curing acrylate technologies. Other resin technologies employed include silicones, mercapto esters, styrenic block copolymers, cyanoacrylates, cationic epoxies, epoxy-functional polymers, unsaturated polyesters and photoinitiator-modified acrylic resins.

Supplier Structure

Some 50 companies produce radiation-cured adhesives in the United States. Dental-adhesive suppliers are the leaders in dollar sales, and 3M, Dentsply Caulk, Kerr Manufacturing and Denmat are the largest. Dymax and Loctite are the leading suppliers of assembly adhesives. Dainippon Ink & Chemicals (DIC), Vantico, DSM Desotech, Sony Chemicals and others supply DVD laminating products. Suppliers of radiation-cured adhesives for flexible-packaging laminates include Northwest Coatings and Craig Adhesives. 3M and Avery Dennison produce radiation-cured pressure sensitive adhesives in-house for high-performance tapes. Sales by merchant adhesive suppliers to pressure-sensitive product manufacturers are currently small, but growing.Outlook

Radiation-cured technology is largely confined to several high-priced adhesive end uses. In these end uses, the technology has grown because of a combination of process, performance and environmental advantages compared to more traditional adhesive technologies. Radiation-cured adhesives will outperform adhesive-industry growth with a 12% yearly increase forecast. New materials continue to play a role in the development of novel formulations and applications.Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!