STRATEGIC SOLUTIONS: Global Adhesive Growth

The United States uses more adhesives in its residential construction when compared to Japan and Western Europe.

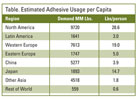

Table. Estimated Adhesive Usage per Capita

At just under 10 billion lbs., North America has not only the largest demand but also the largest per-capita usage, estimated at 28.6 lbs. per person. As the table shows, Western Europe has an estimated 19 lbs. per person and Japan 14.7 lbs. per person. These two countries have lower per-capita usage because 1.) The United States uses more adhesives in its residential construction when compared to these two latter regions; 2.) The number of cars per capita is higher in North America; and 3.) Carpet, which uses adhesives in its manufacturing, is far more prevalent in the U.S. (rugs are commonly used elsewhere).

The overriding trends that occurred in U.S. and Western Europe are expected to repeat in other developing countries, but over a shorter time period. This means that high growth for adhesives will continue to play out for many years.

Adhesive usage in any developing country generally starts with the use of natural adhesives, such as animal glue, casein, etc. With industrialization, however, more synthetic adhesives find usage starting with polyvinyl adhesive types. In addition, as industrialization continues with greater optimization of production and packaging techniques, there is a corresponding optimization in the adhesive type and its application.

Two common examples of applications in the U.S. are the use of hot-melts in packaging and case closing, and the newer modified starches that allow for faster corrugating speeds.

With all of these developments occurring, there has been a natural awareness of the benefits of adhesives and, thus, many new applications have been developed. This is why adhesive growth has always outpaced GDP. It is interesting to note that it has generally taken approximately 18 years for a new adhesive application to be used in about 90% of the product being produced. Many examples of this are evident in the automotive industry. For instance, hem flange bonding was used for the first time on car door manufacturing about 18 years ago. Now 90% of all car doors are manufactured with adhesives.

Of course, much of this time was needed to prove the product's reliability, but it took even longer for other car manufacturers to capitulate to the procedure and implement it into their own assembly processes.

Another factor that has led to the continued growth of adhesives is the blurring of adhesives and sealants into one product: adhesive/sealant. Again, there have been numerous examples of this, with the car windshield adhesive/sealant being the most prominent.

The same overriding trends that have occurred in both North America and Western Europe will continue to happen in other developing countries as well. Developing countries currently have an inordinately high usage of more naturally occurring adhesives when compared to other industrialized nations.

Often, the first step for these developing nations is to use a less-costly synthetic adhesive since speed is not as major a factor due to their lower labor costs. This is expected to gradually change to higher adhesive optimization as labor costs rise and a higher growth of middle class occurs in these countries.

The globalization of the auto and electronics industries has already spurred the adhesives industry to other nations. But, again, developing countries often use manual application techniques due to lower labor costs. However, both the application and the adhesive itself will change over time with increasing optimization of the adhesive.

Perhaps the industry with the greatest dissimilarities among countries will be construction adhesives. This will be due in part to individualized construction techniques, available materials and individualized building standards.

In conclusion, the adhesive industry is expected to continue to enjoy healthy global growth for many years to come. In addition, it is believed that there are undiscovered adhesive opportunities in the construction industry, but this will require adhesive manufacturers themselves to develop these new opportunities.

For more information, phone (513) 469-7555 or visit www.chemquest.com.

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!