STRATEGIC SOLUTIONS: Global PSA Growth Trends

The global pressure-sensitive industry is forecasted to grow 7% per year through 2014.

The pressure-sensitive adhesive (PSA) industry has rebounded well from the great recession. The industry now represents approximately 50 million square meters of coated materials and is forecasted to grow 7% per year through 2014. In excess of 50% of PSAs are produced and coated captively by tape and label manufacturers. For merchant adhesive suppliers, the merchant market is a robust $3 billion, consuming 1,000 kilotons of PSAs.

The pressure-sensitive adhesive (PSA) industry has rebounded well from the great recession. The industry now represents approximately 50 million square meters of coated materials and is forecasted to grow 7% per year through 2014. In excess of 50% of PSAs are produced and coated captively by tape and label manufacturers. For merchant adhesive suppliers, the merchant market is a robust $3 billion, consuming 1,000 kilotons of PSAs.

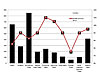

Tapes represent 70% of the market, while labels and graphics represent 21% and 9% of the total, respectively. Specialty tape and medical end uses exhibit the greatest growth prospects. Protective films and paper, as well as electronic applications, are forecasted for double-digit growth. This growth readily corresponds to the explosive use of electronic devices in every aspect of our society. Medical tapes, graphics, foam tapes and double-sided tapes will offer healthy growth of 8-9% globally.

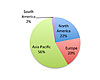

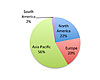

Geographically, the Asia Pacific region is the largest producer of pressure-sensitive materials, with a 56% share of the market (see Figure 1). Within the Asia Pacific, four countries-Japan, China, Korea and Taiwan-dominate the concentration of business; collectively, they account for 93% of the PSA business within the region. North America and Europe are roughly equal in size, at 22% and 20% of the market, respectively. These regions are quite mature and exhibit corresponding competitive dynamics at a macro level as a result.

Solventborne chemistries will maintain their lead over waterborne and hot-melt PSAs over the next five years. Solventborne PSAs account for the majority of merchant adhesives, with 39% of the market. Waterborne chemistry represents 37% of the total and hot melts 18%. Combined, these three technologies represent a 95% concentration, while radiation curing and silicone technologies account for just 5%. Within these technologies, acrylics will maintain their dominance, accounting for nearly two-thirds of all raw materials used.

Solventborne chemistries will maintain their lead over waterborne and hot-melt PSAs over the next five years. Solventborne PSAs account for the majority of merchant adhesives, with 39% of the market. Waterborne chemistry represents 37% of the total and hot melts 18%. Combined, these three technologies represent a 95% concentration, while radiation curing and silicone technologies account for just 5%. Within these technologies, acrylics will maintain their dominance, accounting for nearly two-thirds of all raw materials used.

As for substrates used in pressure-sensitive materials, films dominate with 58% of the total; paper substrates make up 29%, mostly due to their use within the label industry. Foams have grown to represent 6% of pressure-sensitive material usage, while foils remain relatively flat with a 3% share of the market.

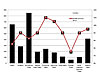

In general, PSAs stand to gain significant ground over the next five years as the industry recoils nicely from the losses caused by the economic downturn (see Figure 2). Over time, the resilience of pressure-sensitive materials as clean, user-friendly technologies for the delivery of bonded materials will continue to outpace the liquid adhesive industry.

For more information, phone (513) 469-7555 or visit www.chemquest.com.

Figure 1. Pressure-Sensitive Material Production by Region.

Tapes represent 70% of the market, while labels and graphics represent 21% and 9% of the total, respectively. Specialty tape and medical end uses exhibit the greatest growth prospects. Protective films and paper, as well as electronic applications, are forecasted for double-digit growth. This growth readily corresponds to the explosive use of electronic devices in every aspect of our society. Medical tapes, graphics, foam tapes and double-sided tapes will offer healthy growth of 8-9% globally.

Geographically, the Asia Pacific region is the largest producer of pressure-sensitive materials, with a 56% share of the market (see Figure 1). Within the Asia Pacific, four countries-Japan, China, Korea and Taiwan-dominate the concentration of business; collectively, they account for 93% of the PSA business within the region. North America and Europe are roughly equal in size, at 22% and 20% of the market, respectively. These regions are quite mature and exhibit corresponding competitive dynamics at a macro level as a result.

Figure 2. End Use Growth Prospects.

As for substrates used in pressure-sensitive materials, films dominate with 58% of the total; paper substrates make up 29%, mostly due to their use within the label industry. Foams have grown to represent 6% of pressure-sensitive material usage, while foils remain relatively flat with a 3% share of the market.

In general, PSAs stand to gain significant ground over the next five years as the industry recoils nicely from the losses caused by the economic downturn (see Figure 2). Over time, the resilience of pressure-sensitive materials as clean, user-friendly technologies for the delivery of bonded materials will continue to outpace the liquid adhesive industry.

For more information, phone (513) 469-7555 or visit www.chemquest.com.

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!