STRATEGIC SOLUTIONS: 2010: Outlook for the Adhesives and Sealants Industry

Within some industries with a heavy influence on adhesives and sealants, such as auto and light truck production, the capacity usage rate is approximately 50%.

Photo courtesy of PRNewsFoto/Porsche Cars North America, Inc.

Photo courtesy of PRNewsFoto/Porsche Cars North America, Inc.

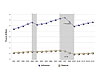

Figure. Adhesive and Sealant Demand Growth Trends in North America

The industry has endured three trying years and the future looks bright, although recovery will be protracted. Four factors in our analysis have led us to this conclusion and provide an outlook scenario for 2010 and beyond:

- Capacity utilization - end market customers as well as the adhesives and sealants manufacturing base

- Slow demand

- Rising raw-material costs

- Possible return to shortages of certain raw materials

Slow demand is a facet of the battered consumer. High unemployment coupled with stricter lending practices signal a long road to recovery. As a result, demand from industrial customers, while stabilized, is 20-25% below prior-year levels. This is particularly the case in the automotive, electronics and metals industries. Similarly, the collapse of housing and commercial construction sectors offers little relief until inventory levels recoup and construction returns to reasonably normal levels, which will not occur until 2012, according to NAHB estimates.

End-use customers find it unconscionable to speak of rising raw material costs during a deep recession. The reality is that adhesives and sealants manufacturers find themselves facing this challenge in the 2009-2010 period. The rationale lies behind an increasing shift to lighter cracking feeds from less-expensive natural gas (which, in turn, decreases production) to avoid processing costlier and heavier feeds from naphtha. As demand dropped, suppliers reacted by reducing rates, taking capacity offline and closing plants to offset capacity-usage reductions. Reduced operating rates add additional cost to these capital-intensive operations. Therefore, eroding margins have now backed many suppliers into a corner, forcing them to take uncompromising stands on price increases. Any further spikes in energy prices will further exacerbate that position. On average, key adhesives and sealants raw materials have risen nearly 180% since the first half of 2009.

Certain raw materials, like isoprene and synthetic rubber, experienced shortages in the years leading up to the recession, which were mitigated due to the sharp retraction. Depending on the recovery rate, as well as the significant shuttering of capacity for high-fixed-cost assets, we could experience shortages again in the near future.

While the outlook is by no means rosy, there are a number of actions that manufacturers should contemplate to ensure profitable results.

- Invest in innovation. Historically, we’ve learned that this pays the best return at the turning point of a recession.

- Structurally examine and/or change the cost structure of the business

through complexity management:

- Evaluate capacity, costs and capabilities.

- Look for greater supply-chain efficiency.

- Apply lean manufacturing principles for cost control.

- Rigorously rank top and bottom performers (products, services, customers). - Focus on creating customized, technical solutions.

- Examine engagements in - or alliances with - dosing, metering and dispensing equipment manufacturers for offering true customized solutions, especially in high-tech fields like electronics, medical devices, white goods, aerospace, and automotive. - Strategically assess the health and prospects of key markets and segments, as well as the main customers you serve or intend to serve. In addition, identify risks and scenarios and develop mitigating contingency plans.

- Focus on cash generation in the short-to-medium term.

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!