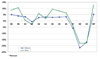

STRATEGIC SOLUTIONS: The New "Normal"

Figure 1.

As we emerge from the economic abyss and the industry begins to claw its way back to 2007 levels, it would be foolish to suppose that all we need to do is to “dust off” those 2007 plans and get back to business as usual. While the strength of the recovery might be debatable, there is no question that the nature of the business landscape has dramatically changed. End-use industries that were at one time huge markets for adhesive and sealant manufacturers (e.g., automotive and construction) will be significantly different in size, structure, and makeup. As we come to grips with what the new “normal” looks like, what issues will adhesive and sealant manufacturers face and how should they deal with them? To address these questions, we’ll use the standard four “Ps” of marketing-product, price, promotion and placement-along with three additional “Ps”-packaging, profit and plan.

Figure 2.

Product

R&D spending has always been seen as a competitive differentiator, yet many companies cut those budgets at the first sign of economic trouble. While this may have helped the bottom line in the short term, it quite likely hurt product development in the long run. In the highly competitive business environment that we will be facing-shrunken markets, fewer customers, etc.-product differentiation will be crucial to success. There will always be “me, too” products, but they will almost always be at commodity price levels (and lower margins).Conversely, companies that continued their investment in technical innovation will be the ones to offer products that have the desired performance characteristics, such as multi-functionality, faster curing, adhesion to a broader range of substrates, sustainability, etc. Thus, companies that were once considered technology leaders but did not continue their efforts at product innovation during the downturn could find themselves in a different position in this new environment, potentially changing the overall competitive landscape.

Price

Price is always a tough, yet inescapable, topic. First, price is largely impacted by the kind of products that you offer. As noted, you’ll likely be at one level for “me, too” products and at a much different level with products that solve a problem and bring more value to the customer (i.e., increase productivity, use less energy, are more user-friendly, etc.). As the economy reemerges, those companies that offer the right products and that have a price that is truly reflective of the products’ value will be the big winners.Like everyone, end users also scaled back staff and operations, so productivity is now more important than ever and the focus is on faster cure times, faster application speeds, less material needed to do the same job, wider operating parameters, etc. In most cases, end users will be willing to pay for these attributes. In addition to asking whether you’re offering the right products, you then need to ask whether those products are priced properly; otherwise, you‘re leaving money on the table.

Promotion and Placement

One element of promotion is sales, and the recent financial turmoil took a toll in this area as well. Like R&D spending, a lot of companies saw sales as an area where cuts could be made as key markets were contracting. There is an old saying among sales professionals that it is far easier to gain share in a down market. Yet some companies furloughed sales staff at a time when many of their customers needed even more support due to their own internal furloughs. Thus, like product innovation, a new dynamic may emerge within some markets, with companies that continued their focus on sales having gained share at the expense of others that didn’t.One of the potential future implications here could be in the area of placement or, for this discussion, channel-to-market. In that some companies may be slow (or even reluctant) to re-staff their sales departments due to uncertainties about the strength of the recovery, they may give serious consideration to outsourcing more of their sales through distribution. Certainly, distribution has always been a key part of the adhesives and sealants industry. However, some companies may only re-staff enough to cover the “big” accounts and have distribution handle more of the sales and technical service responsibilities than ever before.

In addition, many end-use markets have all but moved their manufacturing operations outside of North America over the past two years, which requires a new perspective on how to possibly retain that business (e.g., distribution). This increased role for distribution in both domestic and global markets is another potential aspect of the new “normal.”

Packaging

Packaging is hardly a new concept for the adhesives and sealants industries, as there are plenty of examples where user-friendly methods for delivery are used. For the sake of this discussion, though, we’re referring to the packaging industry, which is one of the biggest users of adhesives and sealants.Here, market forces have almost accelerated. Convenience and portability are driving consumer choices, such as the trend for prepared food that can be cooked in the packaging container and then resealed. Packaging recycling will also become a much bigger issue, with large retailers like Wal-Mart driving the sustainability initiative by changing buying habits and the resulting consumer choices.

There are many good reasons for these initiatives to continue, and there is plenty of regulatory momentum behind them. Thus, the pressures to have higher-performing products with smaller environmental impact will most definitely increase. While adhesives and sealants are certainly important enablers to packaging sustainability, these materials will likely be higher in cost. The big question then becomes whether consumers will pay, and how much.

Profit

Many people think that price and profit are inseparably connected, but that is not always the case. As noted earlier, the price of a product does not always reflect its true value. Unfortunately, the price often does not reflect the costs necessary to sell (discounts and rebates), service (technical and engineering) or supply (special packaging and inventories) the products, either. In the past, companies were dismayed when profit margins were lower than expected due to these factors, but they were usually able to absorb these hidden costs such that their bottom lines were not as adversely affected as they could have been.Over the past few years, though, adhesive and sealant manufacturers have done a credible job of trimming costs and overhead to the point that such unaccounted costs will now have a definitely adverse impact on net profits. Thus, while companies should always price their products according to value and market conditions, they need to be fully mindful of all the costs that impact their profits in the new “normal.”

Plan

Planning is the last and possibly most important aspect. Certainly, very few companies either foresaw or planned for the precipitous fall that the economy took over the past two years. The experience of having gone through it, though, provides several key lessons that need to be heeded and planned for as we move into a new “normal.”For example, many suppliers to the auto industry have been severely impacted by focusing their attention primarily on Detroit’s Big Three, who, as we all know, have gone through some rather painful contractions. As we look to the future, these same suppliers now need to develop plans to diversify their efforts to incorporate auto builders that supply vehicles to consumers in Eastern Europe, Asia, and India, where per-capita car ownership rates greatly lag behind North America and Western Europe and where continued growth is forecast.

In looking at various markets, many companies had allowed themselves to become somewhat concentrated within a few large end-use markets, particularly automotive and construction. With the notable contraction in these markets, it now behooves companies to evaluate and pursue adjacent markets where their products and technologies would be applicable. Like any investment portfolio, diversification-whether market, geographic or technology-is a good thing in the new “normal.” But how can it be accomplished-organically through new product development and market expansion, or inorganically via technology alliance or M&A? The best strategy will be formulated only through a sound planning process. Thus, failing to plan essentially ignores the hard lessons learned over the past two years.

Successful Strategy

What is the new “normal” in the adhesives and sealants industry? It will value innovative products and reward those who provide and price them accordingly. Promotion and placement will continue to be important, although there are indications that distributors will assume more customer sales and support responsibilities. The packaging industry will continue to be very important to adhesives and sealants makers, but there will be continued regulatory pressure regarding sustainability. Profits will continue to be under pressure, not only from rising raw material costs, but by the inability to absorb unaccounted costs associated with selling and servicing customers. Finally, the need to plan for new markets while factoring in all of these new market dynamics is paramount.Richard B. Jones is vice president of The ChemQuest Group Inc., an international strategic management consulting firm specializing in the adhesives, sealants, and coatings industries, headquartered in Cincinnati.

For more information, phone (513) 469-7555 or visit www.chemquest.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!