How is COVID-19 Impacting the Adhesives and Sealants Industry?

Adhesives and sealants companies are facing major challenges on a number of fronts due to the COVID-19 pandemic, but they can take steps to navigate through the crisis.

The staggering ramifications of the COVID-19 pandemic have affected each and every one of us. The global personal losses are simply devastating, and preventative measures such as widespread shutdowns and physical distancing—while necessary—have completely transformed our day-to-day reality into what can feel like a surreal nightmare.

The broad economic effect of the coronavirus is not yet known, and it might not be fully realized for quite some time. What does this mean for adhesives and sealants companies?

Raw Materials

Beyond transportation-related delays arising from travel restrictions and some driver shortage issues, COVID-19 hasn’t hugely impacted supplies of raw materials for adhesives and sealants as of yet, according to Daniel Murad, president of The ChemQuest Group. The situation is highly fluid, but the availability of raw materials such as binders and resins has not yet become an issue.

However, that isn’t the case with all materials. “ChemQuest is learning of shortages in three areas so far: alcohols, which understandably have been diverted toward hand sanitizers and other cleaning products; photoinitiators that are used in UV applications and primarily supplied from Europe and China; and dyes and pigments, which typically are supplied out of India, China, and Europe,” Murad says.

The geographic location of the supplier is a key consideration, with China and India being the most challenging. An additional issue related to China is that the country is “taking a predatory approach,” explains Murad. “A number of clients tell us that they’re seeing 12-15% export tax rebates, which are the highest that we’ve heard from some time, for exported products like pigments and resins as China attempts to regain lost share due to both tariff restrictions and COVID-19.”

End-Use Markets

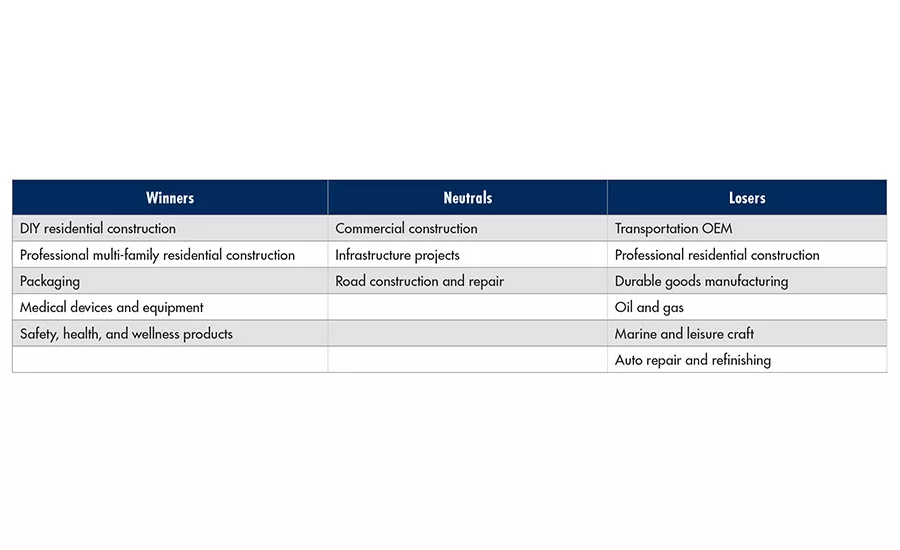

Sectors that use adhesives and sealants are experiencing varying levels of demand due to both the pandemic and massive reductions in oil prices, according to Murad. “We’ve segmented our forecast based on those segments that we believe are going to be winners, those that will be neutral, and those that we believe are going to be losers in the relative short term,” he says.

Winners

One winning sector is benefiting from the wave of stay-at-home orders that have been issued to mitigate the coronavirus’ spread. “Our preliminary view on winners is that the DIY residential is going to come out of this doing very well,” Murad explains. “With more people confined to their homes, home improvement projects are under way. DIY products should benefit from this short-term trend. This is particularly true for interior applications.”

Application equipment for the DIY sector has also seen recent increased demand (10% in volume, 30% in revenue), as have products such as caulks, sealants, and tapes for interior DIY home repair and remodeling. “In fact, Home Depot and Lowe’s are concerned about filling up inventory,” says Murad. “They do remain open, and obviously that’s helped by the DIY focus.”

Professionally applied, multi-family residential projects (especially those in progress) will ultimately be a winner, particularly after stay-at-home orders are eased and work can renew in earnest. “Going into this, demand was really strong,” Murad explains. “Volume was up anywhere from 4-4.5%. Our forecast on revenue was that it was up 8-9%, so really a very solid first quarter. February was up big year over year. March saw some considerable buy-ahead activity by professionals ahead of these shutdowns.”

Packaging is also likely to see strong demand, according to Murad. “We’re projecting a significant uptick in everything from single-serve to microwavable foods, as well as food and beverage packages and containers, flexible packaging, pet food packaging, and any end-of-line case and carton packaging that would meet short-term consumer demand,” he says. “Q1 saw about a 10% increase, which was really helped greatly in March by COVID-19 as people, particularly in food areas, began to hit retail outlets and buy up what they can. Frankly, while we don’t anticipate the extremely high demand that we saw in March to continue in Q2, we do anticipate that this 10% increase will be pretty solid.”

Additional winning sectors include medical devices and equipment, as well as safety, health, and wellness products such as antimicrobials and virucides. “People are scaling production to accommodate the spike in demand by healthcare providers, particularly those that have been heavily impacted with coronavirus infection rates,” says Murad.

Neutrals

Commercial construction (new builds and refurbishments), infrastructure projects, and road construction and repair are industries in the neutral category. “On the one hand, professionally applied projects of this nature are long term, they’re large in scope, they are specification/bid business that are awarded typically several months in advance with anticipated completion that takes 1-2 years or longer, on average, and they incur high costs if projects are cancelled or postponed,” says Murad.

Social distancing practices and stay-at-home orders have made it difficult or impossible for these workers to do their jobs safety, however, so short-term projections are difficult. The picture will be much brighter once these practices are deemed unnecessary, according to Murad, with bottled-up demand providing a fairly rapid recovery.

Losers

Industrial manufacturing is by far the biggest loser as a result of COVID-19, one that won’t begin to ease for quite some time. “Our preliminary, aggregate, macro forecast based on numerous conversations we’ve had in the last two to three weeks, with multiple players in the value chain, is that we’re going to see a 50% decline in April, a 25% decline in May, and a 15% decline in June,” Murad says. “It’s truly unprecedented.”

Transportation OEM is forecast to take a particularly heavy hit. “We believe light vehicle transportation (automotive, light truck), which was already forecast to experience 9-10% declines this year prior to COVID, saw about 39% declines in March and could be impacted by as much as 50% declines in the second quarter. The global effect of coronavirus to automotive supply chains is going to start to bite soon.”

Professionally applied residential construction is also projected to struggle, particularly for interior projects, since homeowners will be watching their budgets and may be uncomfortable having tradesmen inside their homes. “We think that the exterior component of that will be pent-up demand on the other side of COVID-19, and that’s where contractors will be focusing,” Murad explains. “The real challenge is going to be whether professional contractors and service people are going to be allowed back into people’s homes and into buildings. I think that it’s going to create some sort of a COVID-19-free checkbox, similar to background checks.”

Durable goods manufacturing (e.g., furniture, appliances, flooring, general metal finishing) is another sector on the losing end of the spectrum, despite early high demand for appliances such as refrigerators and freezers as consumers resorted to panic-buying massive amounts of both perishable and non-perishable foods. “We made several calls to Lowe’s and Home Depot and Menard’s, and they were out of inventory of appliances,” says Murad. “We think that, as the next quarter evolves, that situation will turn into more of a losing proposition.”

Additional industries that are anticipated to see continued difficulties include: oil and gas, marine, leisure craft, and auto repair and refinishing. “People are at home, and we believe that in the second quarter that’s going to impact about 25% declines,” Murad says.

Navigating the Crisis

Though the economic situation stemming from the COVID-19 pandemic is dire in some cases, it is not necessarily insurmountable. “Timely development and implementation of contingency plans are really critical for business operations, and in particular for key imported raw materials,” Murad explains.

In addition to their previously identified alternate sources for raw materials, he recommends that companies explore additional potential suppliers. Those located in Mexico, Canada, and South America, for example, could enable adhesive and sealant companies to take advantage of still-open trade routes and potential shorter supply chains.

Additional steps that companies can explore include:

- Taking advantage of relevant government stimulus programs

- Launching or strengthening their online channels (e.g., Amazon, eBay), if applicable

- Reallocating production assets to address product shortages (e.g., medical equipment, sanitizers, cleaners, virucides, bactericides)

- Understanding their risk profiles and working toward developing contingency plans for various probabilities and risks

Looking Longer Term

Though we are still in the midst of this pandemic, successful companies will learn from the experience and improve their future operations as a result. “Long term, we think that assessing their internal innovation capabilities to drive mapping, both short term and long term, transportation and shipping logistics, supply chain analysis, are really fundamentals to the domestic adhesive and sealant value chain success,” explains Murad. “It is important for companies to assess their capabilities, reevaluate their business and R&D portfolios for the most attractive growth opportunities, considering the current and fluid market dynamics that are in play as a result of COVID-19.”

The “new normal” we find on the other side of the coronavirus could also actually provide additional opportunities. “There’s going to be quite a few lessons coming out of this, and we feel that it’s going to make some significant changes,” Murad says. “It may accelerate certain areas. For example, e-mobility, we believe is going to be further enhanced as a result of studying the effect of COVID-19.”

For more information, call (513) 469-7555, email info@chemquest.com, or visit www.chemquest.com.

Editor’s note: Listen to my full conversation with Daniel Murad at www.adhesivesmag.com/podcasts.

More COVID-19 coverage from ASI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!