Sustainable Adhesive and Sealant Formulations Hitting their Stride

A 100% post-consumer recycled raw material is delivering real value to adhesive and sealant formulators and end users.

The 100% post-consumer recycled engineered powders are made by diverting used residential asphalt shingles from landfills.

Let’s face it, it’s a lot easier to talk about and set sustainability goals than it is to actually create and launch technically, operationally, and commercially viable greener formulas. The good news is that adhesive and sealant formulators have more choices than ever to help them achieve their goals. The bad news—ironically—is that formulators have more choices than ever to help them achieve their goals.

With fewer staff, tight time constraints, competing priorities, and long product development cycles, it’s imperative that raw material suppliers help prospective users shorten the learning curve and guide them on how best to use these new-to-the-world ingredients, especially when they aren’t drop-in replacements for existing materials. Another challenge faced by many suppliers is overcoming long-held belief systems on the efficacy of recycled and other sustainable ingredients.

A line of engineered powders* was developed to address these challenges, and early adhesive and sealant adopters are finding benefits such as simpler, lower cost, and better-performing formulas with improved manufacturing operations. The engineered product, a highly polar, resinous organic/inorganic composite powder, is a 100% post-consumer recycled product made by diverting used residential asphalt shingles from the landfill.

The powders are manufactured in a patented thermal-mechanical process that delivers properties unlike traditional asphaltic materials and common fillers. It’s these properties that allow the product to be upcycled into a variety of higher value industrial adhesive and sealant formulas, as well as industrial coatings, rubber compounding, and other applications.

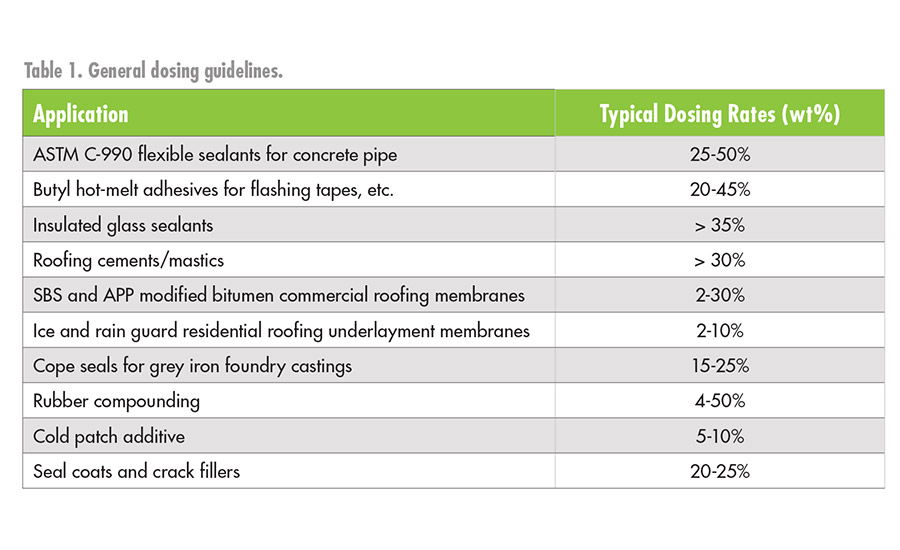

Incorporated both as a process aid at low dosing rates and as a base ingredient at dosing rates up to 50% by weight (see Table 1), the product is being used in the commercial, residential, and infrastructure construction markets, as well as general industrial and road repair/maintenance markets. Applications include SBS and APP membranes and adhesives, colored acrylic coatings for multiple surfaces, flexible sealants, rubber mats and other rubber non-skid surfaces, rubber ramps and wheel stops, roofing mastics and coatings, and more. Butyl hot-melt adhesives were initially targeted, followed by high-volume industrial rubber compounds (EPDM, nitrile, and BR/SBR blends). Butyl sealants for the insulated glass market are currently in development.

The powders were evaluated for, and are in compliance with, all communication requirements of EU REACH, CA Prop 65, and U.S. TSCA regulations. Further product testing by third-party certified laboratories was conducted to determine the presence or absence of various chemical families such as phthalates, heavy metals, SVOCs, and PAHs. None exceeded EU REACH thresholds, and most were below detectable levels.

*Harmonite® engineered powders, developed by RSS, LLC, a wholly owned subsidiary of The Dupps Co.

Insulated Glass Sealant Development

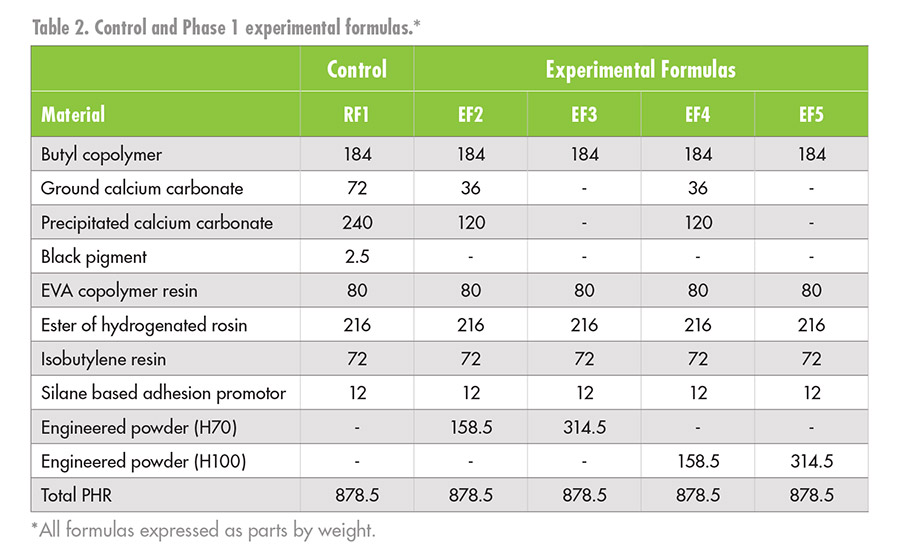

Similar to the formulation work on butyl hot-melt adhesives previously reported,1 the first phase of a new independent third-party R&D project on secondary seals for insulated glass units was recently completed. Starting with a published butyl hot-melt reference formula (see Table 2), attempts were made to simplify it while delivering equal or better performance at a lower total cost. Experimental formulas using two different grades of the engineered material were compared to the reference formula and to a commercially available insulated glass sealant.

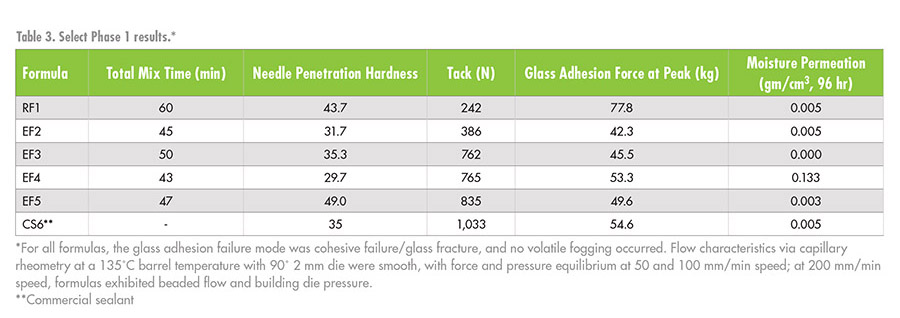

The Phase 1 work was used to reduce and then eliminate three ingredients: ground calcium carbonate, precipitated calcium carbonate, and black pigment. The experimental formulas compared favorably across virtually all key metrics to both the reference R&D formula and to the commercially available sealant (see Table 3).

Mixing was accomplished via a sigma blade mixer to mimic mixers commonly used in the industry. As can be seen from the table, all experimental formulas demonstrated significantly shorter mixing times (as much as 28% shorter). These results show that a formulator could reduce its cost of goods sold through reduced labor and power, producing the same amount of sealant in less time. Alternately, the formulator could improve its return on capital by generating incremental growth and revenue on the same equipment, without having to invest additional capital.

Formula economics should also be favorable when considering the weighted cost of the materials that were replaced. Based on a range of estimated current market prices for various grades of the three ingredients that were replaced, formula costs could be reduced by as much as $0.07/lb or more.

The planned second phase of the project, scheduled to begin shortly, will look at the feasibility of reducing consumption of the ester of rosin tackifier and EVA copolymer resin. Results (good or bad) are then intended to be shared with prospective clients to help spark ideas and discover how the product might fit into their formulation strategies and sustainability goals.

Case Study: HMPSA for Construction Flashing Tape

A well-respected and forward-thinking tape manufacturer and toll processor for nationally branded hot-melt pressure-sensitive adhesive (HMPSA) tape customers has been growing rapidly and expanding its presence in multiple market segments, including the construction industry. This manufacturer wanted to formulate a butyl flashing tape with a “greener” story.

Unfortunately, after the company had qualified and started using a different recycled shingle compound as a filler material, the product was withdrawn from the market. That compound, while adequate, had a high moisture content that introduced several processing problems: it tended to agglomerate, which made handling more difficult, and mixing times were extended because the water had to be driven off prior to creating an acceptable adhesive.

The manufacturer then resorted to using calcium carbonate as a filler material. The material’s weight, as well as the limitations of the existing mixing equipment, prevented the company from utilizing the full capacity of its process vessels. After thorough testing, the manufacturer selected the engineered powders discussed here to meet its goals.

The manufacturer has been successfully using the product for more than four years, with no reported problems. Even though they are a bit more expensive on a per-pound basis than calcium carbonate, the engineered powders achieve a lower total cost in use, improved tape performance characteristics, and increased productivity. Because of the nature of the powders’ polar resin/asphaltene chemistry, the manufacturer was able to lower its cost by reducing the weight percentage of more costly polymers, resins, and processing ingredients. In addition, the manufacturer reported that the product increases viscosity and internal strength in the adhesive, both of which contribute to improved sag resistance.

The tape manufacturer was also able to increase production with the same equipment and process. The company reported that the lower specific gravity and good blending capability of the product, as compared to calcium carbonate, allows it to maximize its batch sizes, and the low moisture content of the product (< 1%) decreases processing time and improves handling when compared to the previous recycled product that had been discontinued. In addition, incorporating the sustainably produced product into the manufacturer’s PSA tape allows builders and architects that specify that tape to contribute to earning LEED credits for their buildings.

Going Mainstream

Tremendous inroads have been made in recent years by a variety of sustainable, recycled raw materials. But regardless of the feel-good intangible bump one gets from formulating with these materials, they have to deliver the goods. No one subsidizes inferior ingredients just because they’re sustainable.

“Green” materials must deliver tangible benefits like reduced cost, equal/better product performance, or improved manufacturing operations. With continued focus, these types of raw materials will continue to make further inroads and become mainstream in multiple markets and applications.

For more information, contact the author at (937) 855-0585 or kthomas@dupps.com, or visit www.rssharmonite.com.

Reference

- Thomas, Ken, “Reshaping Adhesive and Sealant Formulation Strategies,” Adhesives & Sealants Industry, October 2017, pp. 20-25.

Listen to our podcast with Ken Thomas!![]()

![]()

![]()

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!