Strategic Solutions

Market Opportunities for Structural Adhesives

Structural adhesives’ volume is expected to increase as pure electric vehicles displace internal combustion engines in the marketplace.

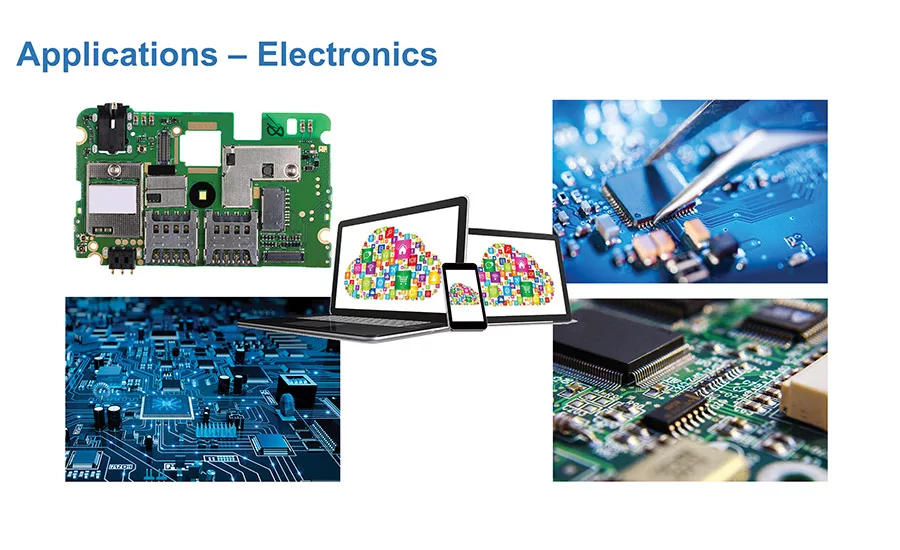

Figure 1. Structural adhesives in electronics applications.

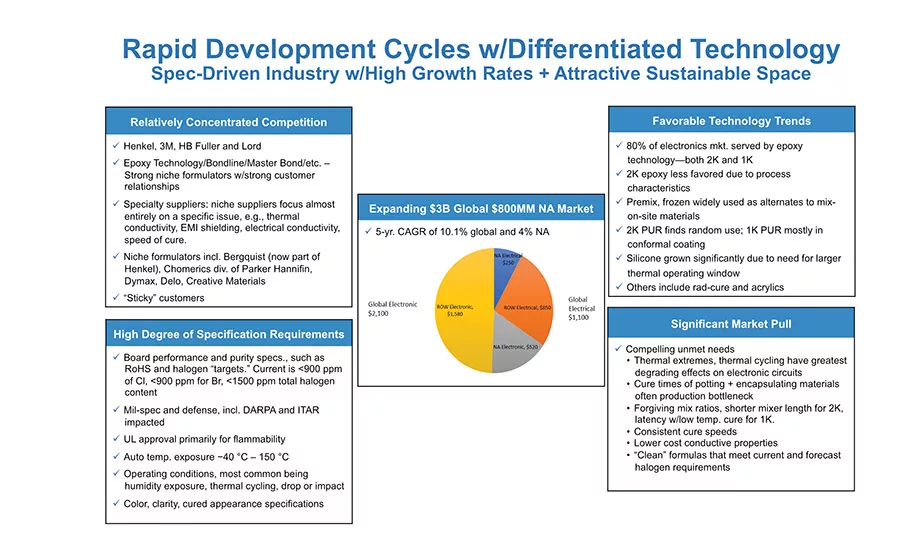

Figure 2. Structural adhesives’ use in the electronics/electrical assembly market.

Structural adhesives are displacing mechanical fasteners, welding and even tape in some fastening applications. According to practitioners, the profile of reactive chemistry primarily comprises polyurethane, acrylic and epoxy resins, and reactive hot-melt technology for structural applications (albeit no water-based chemistry).

Market leaders are forecasting structural adhesives’ annual volume growth well above U.S. gross domestic product in key markets such as transportation and original equipment manufacturing (OEM)/product assembly through 2020. The latter market is complex and fragmented with respect to the use of structural adhesives; those unmet market needs are driving innovation and growth.1

One such need is a universal surface preparation method suitable for all substrate materials and surface conditions, which is mostly an ongoing unmet need. Surface-tolerant adhesives are an alternative; acrylic growth, for example, is especially robust due to acrylics’ ability to adhere to oily surfaces.

Market Overview

Bonding dissimilar materials on a vehicle production line has been identified as a key driver. Educating engineers and sourcing managers on structural adhesives’ performance capabilities, as well as key advantages such as improved processes and waste reduction as compared to incumbent joining methods, is said to be central to conveying the overall value proposition.2 The popularity of structural I-beams, floor joists and sandwich panels in modular construction are leading substitution drivers.

Structural adhesives’ volume will increase as pure electric vehicles (EVs) displace internal combustion engines (ICs) in the marketplace, due to EV and IC build and component differences. Bucking historical trends, OEMs have also become the primary decision-makers for selecting materials used in automotive refinish (collision repair) applications due to the proliferation of sensors and electronics in today’s passenger cars.3 Adhesive usage is decreasing in tandem with fewer repairs, a trend that is associated not only with an ongoing lower incidence of vehicle accidents but also the tendency of insurance adjusters to “total-out” vehicles rather than reimburse for costly vehicle repairs involving airbags and electrical systems.

Gains in share over other joining technologies break out differently among OEM sub-segments. In electronics assembly, for example, tapes are losing share to structural adhesives due to miniaturization and the subsequent need for stronger and thinner bond lines. On the other hand, advances and increased production in electrical equipment such as transformers and junction boxes and newly constructed transmission towers—along with periodic upgrades of existing electrical equipment and associated joining systems—lead to the increased use of structural adhesives.

Adhesives and tapes with high heat resistance are in demand because modern transformers tend to generate higher temperatures than their predecessors, as they are exponentially more powerful and more compact. Mechanical fasteners are declining in use for junction boxes due to the perceived risk of signal interference. Silicone is used in specialized applications in which extremely high heat tolerance is needed, though the market’s perception of silicone as a possible contaminant in surrounding operations is thought to be a limiting factor. Average growth in the combined electronic/electrical sub-segment, which is said to mirror U.S. economic growth, is estimated at approximately 4% (electronics growth dominates at ~7%), as shown in Figures 1 and 2.

In the general industrial segment, growth is estimated at 3-4% per year, with 100% solids displacing solvent- reduced adhesives in sub-segments where lower volatile organic compound (VOC) materials are required. VOC concerns were similarly cited in the transportation sector. Growth for acrylics in certain applications, apart from attractive pricing, is predicated on performance characteristics by substrate type and environment.

Sustainability coupled with an attractive price-performance ratio is another driver for structural adhesive buying decisions in end-use markets. Otherwise, price becomes the overriding factor, in most cases reducing a strong interest in a sustainable solution to a nice-to-have feature. In keeping with a higher degree of service for testing and application services, developing a trusted relationship has been noted as a significant factor in a rigorous process for qualifying a new adhesive product to meet user specifications.

Multinational adhesives and sealants brands are sought after by small- to medium-sized companies with fewer internal resources, but the smaller volumes and customization that are mainstays in the structural adhesives markets nicely accommodate smaller niche adhesive producers. The high barriers of entry for structural adhesive suppliers are outlined in Table 1. Collaborations among technology institutes, universities, OEMs and suppliers are increasingly forming to explore new ideas for overcoming barriers to using structural adhesives and advancing material science.

References

- “2017-2020 ASC North American Market Report for Adhesives and Sealants, with a Global Overview,” The ChemQuest Group Inc., 2017.

- Swope, James, “Adhesive and Sealants Use in Automotive Drive Train: How Do Internal Combustion Engines Differ from Electric Motors?” The ChemQuest Group Inc., www.adhesives.org, 2019.

- Lotz, Aggie and Murad, Daniel S., “Beyond Adhesion: Disruptive Innovation Has Impacted Transportation Applications of Adhesives and Sealants,” The ChemQuest Group Inc., Adhesives & Sealants Industry, March 2018, www.adhesivesmag.com/articles/96122-beyond-adhesion.

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!