Strategic Solutions

Switching Production to Satisfy Shifts in Demand

Production cycle planning and excess capacity can yield unexpected advantages.

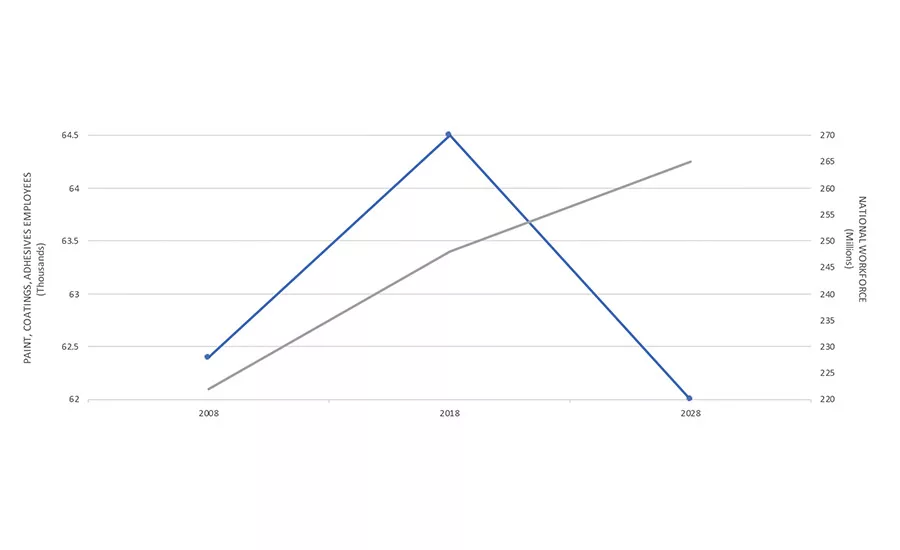

Figure 1. U.S. job growth forecast, 2008-2028.1

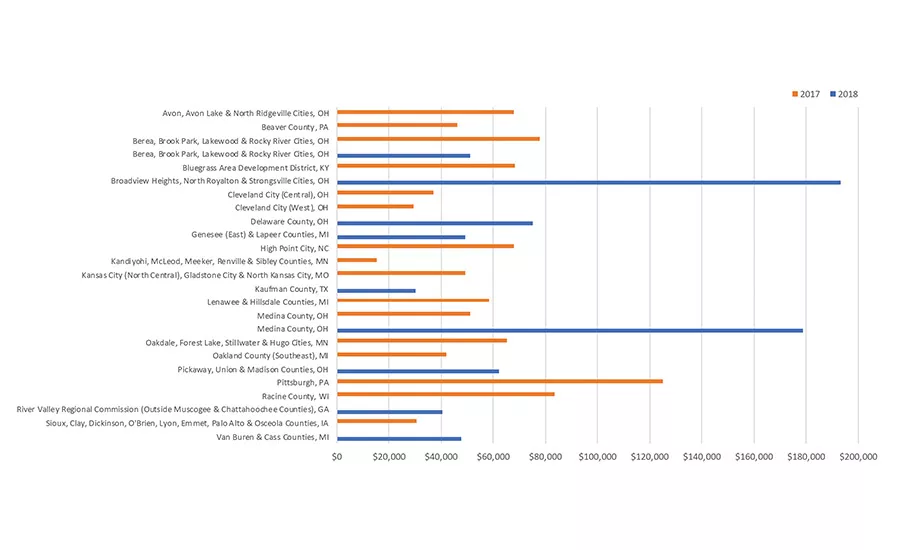

Figure 2. Average domestic wage for paint, coatings, and adhesives, 2017 and 2018.1

The specialty chemicals value chain has risen to the challenge of retooling to fill large supply gaps for sanitation products, packaging containers and inks, and other essential products to meet spikes in demand as an outgrowth of the COVID-19 pandemic. Contract manufacturers have stepped up to meet the short- and in some cases longer-term production demand. Like most new ventures, there is a learning curve for newcomers to contract manufacturing.

Manufacturing Objectives

Switching production from one type of product to another, such as from coatings to adhesives (or vice versa), may entail unfamiliar logistics and costs. Establishing manufacturing objectives to include transparent cost parameters between a contract manufacturer and a prospective customer is recommended at the outset. Who is supplying the formula? Who is sourcing raw materials? What is the timeline? Is this a short- or potentially longer-term engagement? What are the volume and packaging requirements and expected profit margin? How is the product being brought to market?

With complete answers to these questions, a contract manufacturer can address the pricing question early in the process. Separately, we’ll explore the strategic value beyond unit cost.

Production Capabilities

Contract manufacturers and their personnel have various track records of success. Among the capabilities a customer should seek in a contract coatings producer is consistently meeting quality standards. Batch consistency, including achieving required viscosity and color using associated quality control checks and actions, is essential. Expanding your initial evaluation of a contract manufacturer’s capabilities should include the following criteria:

- Company reputation

- Quality system (e.g., ISO-9000)

- Raw material management

- Process control

- Finished goods storage and handling

- Environmental, health, and safety record

Documentation In Lieu of a Site Visit

Until stay-at-home orders are relaxed, a contract manufacturer’s business reputation and documentation are invaluable to new customers. It’s not unreasonable to request by email a contract manufacturer’s current ISO certificate and supporting documentation to ensure adequate process control, raw materials management, and quality management program.

When the end product has been fully evaluated and quality control checks are in place, a “walk before you run approach” involving a gradual scale-up is recommended to uncover the various idiosyncrasies of formulas, production processes, and end products. A standard proof of concept is attained by producing small batches of coatings on plant equipment.

The proof of concept sometimes reveals otherwise masked quality issues. For example, skipping small batch production—scaling up to 2,000-gal batches in large vessels from laboratory samples—may generate an unanticipated high level of process heat, resulting in catastrophic product loss.

Independent testing facilities equipped with real-world manufacturing equipment are value-added partners in mitigating against such catastrophic product loss. Proper filtration techniques are essential to producing a quality liquid coating. Likewise, qualified and experienced R&D testing staff are always on-site and available to manage the testing.

Not New: Managing Short-Term Influx

Contract manufacturers have procedures in place and regularly ramp up to accommodate huge influxes of production following natural disasters such as hurricanes. Considering a short-term contract arrangement following a natural disaster is predicated on the total value provided to the customer (e.g., avoiding losing face with key end customers or even market share), rather than an evaluation based solely on a higher-than-expected unit cost.

Timing for transitioning production back to the customer should be planned for at the outset. Otherwise, challenges arise in transitioning purchase orders of raw materials and transferring or disposing of inventory, including quality control batch sample retains. Overall, tapping a contract manufacturer for assistance to mitigate a production disruption offers a great deal of flexibility and makes good business sense, but not only in a crisis.

Strategic Value

Over the past decade, many businesses have been working around high employee turnover. Annual quality audits allow a contract manufacturer to bring new employees at the customer location up to speed. New customer employees are often surprised to learn their contract manufacturer is putting their own mark on the business in areas such as quality assurance, performance optimization, and EHS management.

On the surface, bringing outsourced production back in-house to increase capacity (e.g., from 85 to 95%) may seem like a win. On a unit basis, it may even look cost effective. In reality, when new (more profitable) opportunities arise, the customer may not have the ability to capture the additional profit due to capacity constraints. In contrast, the profitable strategy is long-term outsourcing of lower-margin material production to focus on acquiring new business in higher-value materials.

A customer’s employee turnover often conflicts with leveraging such a strategy, but not due to a natural learning curve. Rather, the conflict occurs when a new employee’s primary objective is advancing their own career in a timeframe of three to six months vs. managing their employer’s maximum profitability over three to five years. This is why C-suite involvement in capacity strategies can make a significant difference in a company’s profitability.

Reference

- “Paint, Coating, and Adhesive Manufacturing,” Data USA, https://datausa.io/profile/naics/paint-coating-adhesive-manufacturing-.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!