Strategic Solutions

Beyond Adhesion: Disruptive Innovation’s Impact in Transportation Adhesives

Part two of this series compares consumption trends in automotive powertrain adhesives and sealants to those of pure electric drivetrains.

In internal combustion (IC) engines, epoxy, silicone and UV/visible light-curing formulations offer enhanced capabilities and speed productivity to meet OEM and tier suppliers’ requirements. Significant innovations in gasketing, impregnation compounds, and bonding and potting can improve overall performance for automotive assembly applications.

One-component (1K), no-mix, heat-curable epoxies and anaerobic acrylates promote porosity sealing of powertrain components. Impregnation compounds provide fast, moderate temperature processing, prevent corrosion, reduce costs and are durable in harsh environments. In addition, thin-walled die castings that meet stringent quality specifications are used in high-pressure fluid retaining designs that reduce product rejection rates while lowering fuel consumption via lighter-weight parts.

One- and two-component potting compounds for applications in ignition coils, electronic control units, transmission controllers, and sensors/connectors, protect engine components against harsh environmental exposure. Special grades are thermally conductive and have superior heat dissipation properties. UV-cure systems cure rapidly, require no mixing and, for all intents and purposes, provide unlimited working life and meet demand for improved productivity.

Formed-in-place and cured-in-place liquid gasketing compounds, which have largely displaced molded, die-cut gaskets, effectively protect and seal powertrain components (see Figure 1). For example, liquid gaskets achieve up to a 95% material savings over hard rubber gaskets. They also prevent leakage from crankcase/gear oils, coolants and transmission fluids. In addition, gasketing materials guard against exposure to extreme temperature, moisture, UV light, dust, dirt and road salts.

Robotically dispensed 1K and 2K component systems are used by automotive OEMs and tier-one and tier-two suppliers for high-volume production operations. These technologies feature superior flexibility and elongation, absorb shock and vibration, adhere well to metal/engineered plastic substrates, and have rapid cure cycles. Moreover, their precise, consistent, automated dispensing increases productivity/part quality, decreases material consumption, and eliminates the need for manual labor-intensive manufacturing activities. In summary, liquid gaskets offer excellent adhesion to a variety of substrates and modern lightweight materials, delivering lower cost per assembly, with an opportunity for an integrated gasket on the part. However, the rise of composite gaskets is a potential headwind that should be monitored.

Pure Electric Drivetrain Adhesive and Sealant Trends

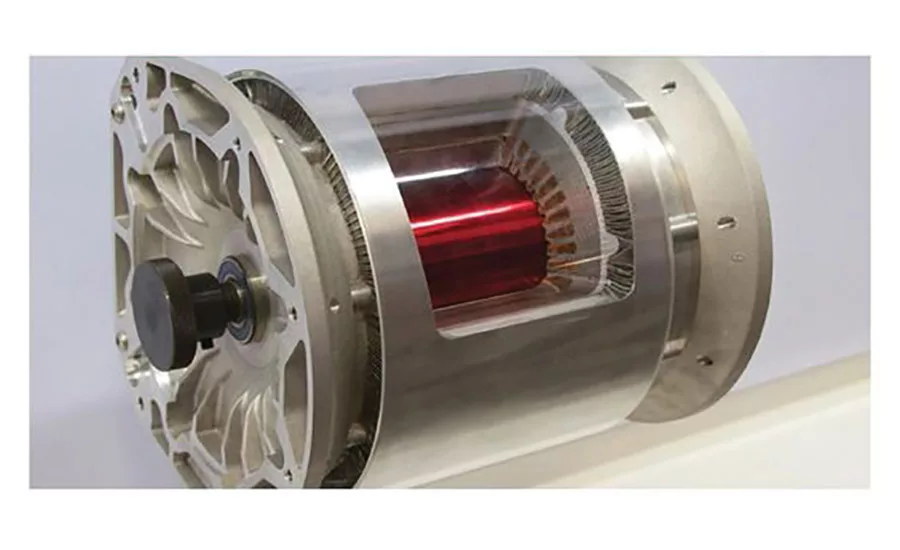

While the overall demand is strong for liquid adhesives and sealants in the assembly of pure electric vehicle drivetrain parts and components (particularly in battery construction), there is a caveat: chemical bonding and sealing consumption will decrease with the removal of fluid management systems (e.g., coolant, oil and fuel). Pure electric vehicle chemical bonding applications are typical of other electric motor construction. Bearing retention, gear mounting, shaft bonding, and strain relief, as well as selective encapsulation of electrical connections, are examples of adhesive and sealant applications. Several (such as GM’s offerings) use DC motor construction with magnet bonding as an added application, while others (including Tesla) use an AC induction drive in which the second electromagnetic field replaces permanent magnets. Figure 2 (p. 14) illustrates a Tesla electric vehicle (EV) motor design.

High-volume adhesive and sealant applications for pure EV applications (also applicable to its hybrid cousin) are in battery construction. Tesla Model S depicts the battery pack and structural framing forming the base of the vehicle. (As shown in Figure 3 (p. 14) and

Figure 4 (p. 18), significant aluminum and stainless steel is in use.) Here, a two-component polyurethane adhesive is favored with bonding properties that perform well for both stainless and aluminum for structural members (including mounting plates). UV-cured acrylated polyurethane and UHB tapes are used for bonding insulation materials such as Mylar® and Kapton®. Both silicone and polyurethane sealants are used to seal batteries, although some are still welded.

Automotive Electronics and Electrical Controls

Historically, automotive electronics and electrical controls have been housed in sealed enclosures. Before now, a conformal coating was rarely used. A trend toward the use of conformal coatings on boards—both in enclosures and in passenger compartments—is emerging. Also emerging are unmet user needs for:

- Easily mixable two-component systems with 30 min+ mix life, and high green strength

- Fuel resistance (including alcohols)

- Extreme temperature-resistance properties, ranging from -40˚F to +280°F at load

- Materials that aid in heat dissipation of electronics

- In battery construction, barrier properties to 02 are especially sought after

Case sealants tend toward electronic-grade silicones, while acetoxy silicones are used if connectors are potted and boards are coated. Typically, potting compounds are epoxy-based for their excellent fuel and temperature resistance, although polyurethanes are growing in popularity. Two-component silicones (primarily gels) are being used for shock-sensitive components.

Growth in automotive electronics is tangential to electronic modules. Forecasts are for the increased use of displays and cameras as automotive OEMs explore the benefits of eliminating side-view mirrors, including weight reduction and improved aerodynamics. Also noteworthy is the multifunctional nature of touchscreen displays that will allow consolidation of control functions. Adhesive and sealant applications include displays, both touchscreen and informational; camera systems, noting the use of light-activated acrylic polyurethane used for bonding in displays; and well as 2K aliphatic polyurethane adhesives and 2K high-clarity silicones. Cameras use a variety of technologies, including 2K epoxies, cationic epoxies, light-cured acrylics and cyanoacrylate (CA) adhesives.

Pure Electric Drive Gearbox Trends

In pure electric drive vehicles, high torque requirements may render IC gearbox designs obsolete—with a possible “domino effect” on the entire IC powertrain assembly—as electric drive replaces IC engines. Conversely, near-term demand for hybrids in the U.S. will likely require the redesign of gearboxes. Automakers, squeezing more value out of their sunk costs in IC engines, may turn to overdrive gearboxes that use synthetic lubricants to achieve economy, possibly creating an unmet need for compatible sealants (as shown on Figure 5). However, suspension components would remain unaffected.

Final Thoughts

This series highlights only a few emerging material trends, vehicle components and assembly designs in the transportation OEM sector. To remain relevant in their markets, incumbents have little choice but to analyze these and many other factors influencing future vehicle production. Will your adhesive and sealant product portfolios be specified by end users in 2030? If not, what changes are required now to your technology and product mix for successfully positioning your company for future sales opportunities? ASI

Click here to see part 1 of this series.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!