Market Trends

The Future of Pressure-Sensitive Graphic Films

Vehicle graphics are predicted to be the fastest-growing segment in the next two years.

Today, pressure-sensitive graphic films are required to perform an extraordinary and ever-changing number of functions across a variety of industries, including building and construction, road traffic signage, home décor, and large-format weather-resistant labels, in addition to the “traditional” markets of outdoor advertising, point-of-purchase promotions, and vehicle graphics. This broad marketplace is the base-level indicator that every single component of the pressure-sensitive laminate has a critical role to play, and is subject to in-depth specification. A recent report from AWA Alexander Watson Associates, “AWA Global Pressure-Sensitive Graphic Films Market Study 2016,” defines current market status and provides an assessment of the future in terms of materials, markets, and converting technologies.

Global Market Growth

Overall, the market is healthy; global 2015 volume usage was 2,300 million sq m, and the compound annual growth rate (CAGR) was 6.3% between 2013 and 2015. AWA expects the market to continue to grow at 5.6% annually over the next two years—but not necessarily in the traditional segments.

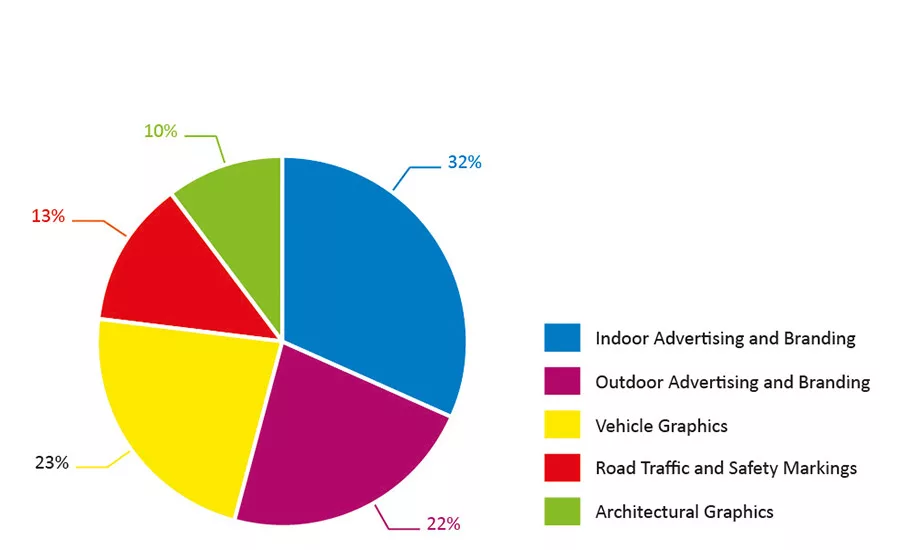

While indoor advertising and branding applications remain the biggest segment, representing 32% of total demand, vehicle graphics hold second place at 23%. Growth in outdoor advertising is predicted to be slower than in other markets, as digital out-of-home advertising increasingly replaces the complexity of printing, applying, and removing large-format film-based graphics.

Vehicle graphics are predicted to be the fastest-growing segment in the next two years, featuring medium-life polymeric calendered films—particularly for leased vehicle fleets—and durable, conformable, high-quality cast films for long-life commercial fleet markings and personalized vehicle body wraps. Monomeric calendered films, the workhorse of the industry, will still grow at a healthy 5.9% CAGR in the short term.

A relatively new end-use market for self-adhesive graphic films—architectural graphics—is evidencing strong growth too, at an estimated annual 6.3% to 2018. This category comprises a variety of different applications and uses, both indoors and out, for every type of film, including reflective/fluorescent engineered films for road traffic and safety markings. Alongside traditional uses such as directional signage, durable external color facings on buildings, and screening and safety markings on glass walls, pressure-sensitive graphic films are contributing to new aspects of home décor.

Currently trending in this segment is the provision of high-visibility interior wallcoverings—some personalized, particularly for “feature walls”—and also the creation of graphics on items of furniture.

Acrylic Adhesives

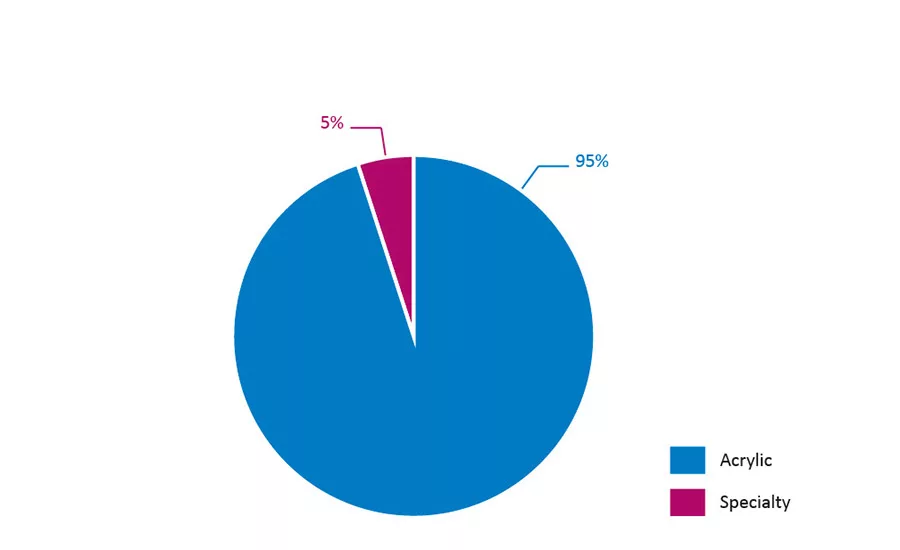

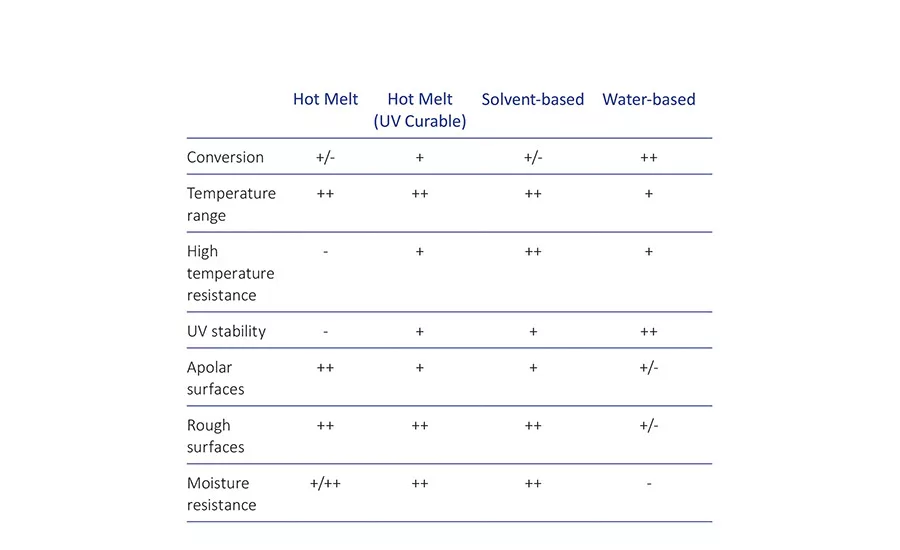

Whatever the application, the individual characteristics of a face film must be partnered with an adhesive suited to its particular needs. They may include regulatory requirements, as well as those for fire resistance/sea water resistance, high- and low-temperature resistance, weather resistance, and application to rough and apolar surfaces. All adhesive formulation types play a role in this arena, although AWA estimates that solvent- and water-based acrylic adhesives account for 95% of the market, with the remaining 5% specialist formulations.

Adhesives for pressure-sensitive graphics may also usefully assist in meeting a variety of application-specific requirements. Gray/black adhesives, for example, are used to “block out” any marks or colors on the application substrate for the graphic. In addition, solvent-based adhesives offer high adhesion values.

Release Liners

Release liner substrates—including clay-coated paper, polyolefin-coated paper, and film—are also a critical element. Stability and layflatness characteristics are the key facilitators of high-quality graphic conversion, and their handling properties provide the route to smooth graphic application. Polyolefin- and clay-coated papers dominate, representing 44% and 40%, respectively, of today’s global market.

Imaging Technologies

As in all aspects of print and graphics, the conversion and end-use of pressure-sensitive films are being modulated by technology at all levels. Whatever the end use of the graphic, the laminate of face film, adhesive, and liner must work effectively as a whole for the converter, who may be using any of the sheet- or roll-fed digital imaging technologies, as well as thermal transfer, screen, offset, or straightforward computer cutting. Current and ongoing investment in the inkjet technologies makes it evident that these will be the future choice for pressure-sensitive graphics conversion.

Complex Value Chain

The pressure-sensitive graphics value chain is interestingly complex. The customer—the converter—is generally a small- or medium-sized business that must source its product needs for specific specialist jobs from the huge variety of materials offered by many manufacturers around the world. Since order quantities are often small, a base of specialist distributors and resellers around the world has developed to supply signage and graphics components to converters at a local level. Only a very few large converters are able to order direct from material manufacturers, so the distributor network is a key feature of the industry.

Regional Demand

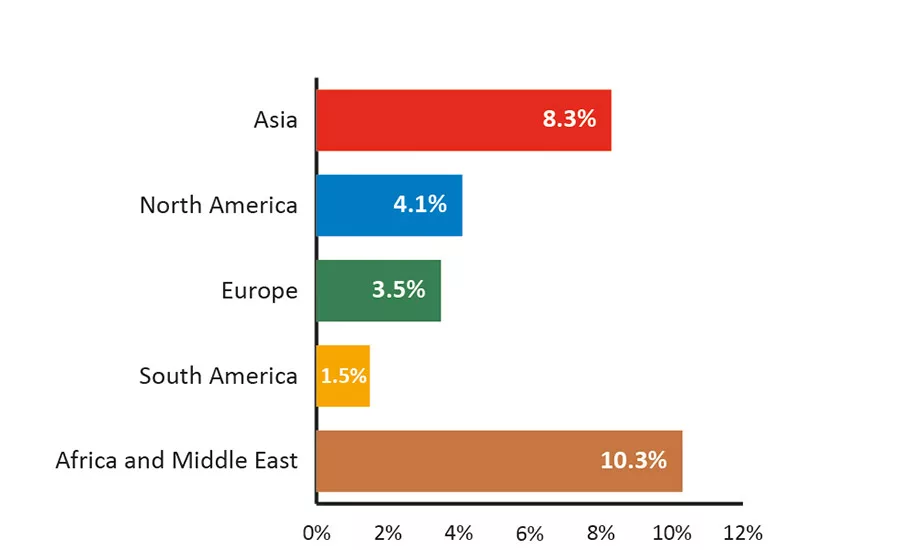

Significant differences are found across the globe in regional demand for pressure-sensitive graphic films. Today, Asia is the largest region, representing 36% of global demand and replacing North America, which now holds second place at 29%. Africa and the Middle East are evincing the highest regional growth characteristics—albeit from a low base—at 10% per year. ASI

For more information, visit www.awa-bv.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!